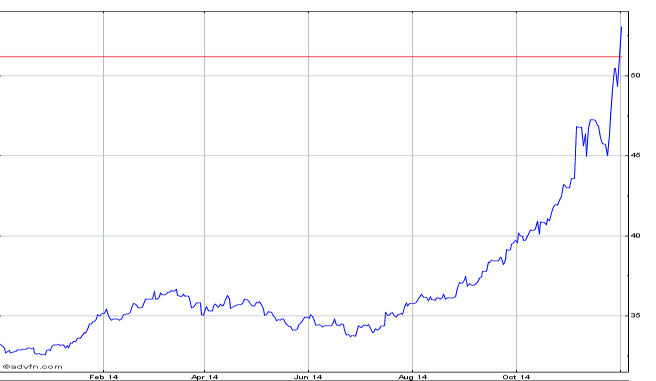

The Russian Rouble is currently trading at 53 Roubles to the US dollar, an all time low. Earlier this year a dollar bought less than 35 roubles. The collapse of the currency has been in part due to the sanctions imposed following Crimean/Ukranian crisis but more recently by the steep fall in the price of oil below $70 a barrel. This petro-economy is reliant on oil to balance the budget with oil and gas providing nearly two thirds of Russia’s exports and providing half of its fiscal revenues.

What’s more with over $600 billion of US dollar denominated debt, the further the currency falls the harder it is for Russian companies to meet debt payments. The only bright spot amongst the carnage is that it is good news for Russian exporters selling goods priced in roubles as the prices of their goods becomes cheaper overseas (not so good for those exporting goods priced in US dollars).

Some are now saying that the Russian central bank will introduce currency controls to stem the tide and even if this doesn’t happen interest rates could rise even higher than the 9.5% level they were raised to in November. Earlier this week there were reports that some of Russia’s banks had started limiting sales of dollars and euros to $10,000 or €10,000 per customer.

Prices for Russian debt have also fallen sharply with the spread between US treasuries and Russian debt due in 2030 to a post-2008 year high of 380 basis points. The cost of insuring Russian sovereign debt against default, measured in five-year credit default swaps, jumped by about 30 basis points on Monday, rising to a level last seen in 2008/2009.

So plenty for the Russian Central bank and President Putin to think about as the currency crisis goes on.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Staggering fall in Rouble versus US dollar as oil price and sanctions hurt

Dec 2, 2014 at 12:28 pm in Market Commentary by contrarianuk

The Russian Rouble is currently trading at 53 Roubles to the US dollar, an all time low. Earlier this year a dollar bought less than 35 roubles. The collapse of the currency has been in part due to the sanctions imposed following Crimean/Ukranian crisis but more recently by the steep fall in the price of oil below $70 a barrel. This petro-economy is reliant on oil to balance the budget with oil and gas providing nearly two thirds of Russia’s exports and providing half of its fiscal revenues.

What’s more with over $600 billion of US dollar denominated debt, the further the currency falls the harder it is for Russian companies to meet debt payments. The only bright spot amongst the carnage is that it is good news for Russian exporters selling goods priced in roubles as the prices of their goods becomes cheaper overseas (not so good for those exporting goods priced in US dollars).

Some are now saying that the Russian central bank will introduce currency controls to stem the tide and even if this doesn’t happen interest rates could rise even higher than the 9.5% level they were raised to in November. Earlier this week there were reports that some of Russia’s banks had started limiting sales of dollars and euros to $10,000 or €10,000 per customer.

Prices for Russian debt have also fallen sharply with the spread between US treasuries and Russian debt due in 2030 to a post-2008 year high of 380 basis points. The cost of insuring Russian sovereign debt against default, measured in five-year credit default swaps, jumped by about 30 basis points on Monday, rising to a level last seen in 2008/2009.

So plenty for the Russian Central bank and President Putin to think about as the currency crisis goes on.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.