The US dollar has been unstoppable of late with the Dollar Index which compares the currency against a basket of other global currencies rising to 84.3. It is now up for nine weeks in a row, a record not seen since 1997.

A few years ago, many were saying the US dollar was dead as a the global reserve currency given the huge amount of dollars that the US Federal Reserve was printing as a result of its gigantic asset purchase programme. With weak Japanese growth, reduced European interest rates and trouble in the Ukraine and middle east, the US dollar’s reputation as a safe haven has grown in stature in recent months. Positive economic data from the United States mean that commentators are expecting the Federal Reserve to raise interest rates sooner rather than later in 2015, adding to the appeal of the currency.

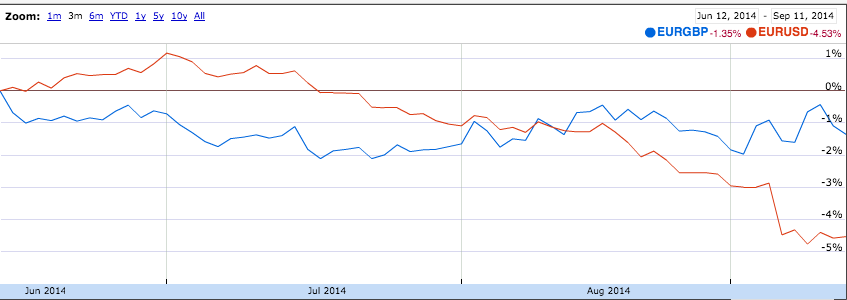

With this huge rally in the US dollar, the prospect of another currency such as the Chinese Renminbi taking over as the world’s lead currency looks even more distant in 2014 compared to turmoil of the economic crisis of 2008/2009. With eurozone growth pretty tame if not non existent, the European Central Bank has been forced to resort to a UK/US style bond buying programme to aid liquidity and investment in other asset classes. This has hampered the euro of late and has made the US dollar make significant gains against the eurozone currency since the ECB announcement.

Whether the rise in the US dollar in the last 2 months is sustainable is a big question after weak non-farm payroll numbers last month put into question how quickly the Fed would raise interest rates. In the meantime there’s little sign of investors taking their foot of the gas in buying the green back. An incredible run that’s for sure.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

US dollar on track for highest run of weekly gains since 1997

Sep 12, 2014 at 2:51 pm in Market Commentary by contrarianuk

The US dollar has been unstoppable of late with the Dollar Index which compares the currency against a basket of other global currencies rising to 84.3. It is now up for nine weeks in a row, a record not seen since 1997.

A few years ago, many were saying the US dollar was dead as a the global reserve currency given the huge amount of dollars that the US Federal Reserve was printing as a result of its gigantic asset purchase programme. With weak Japanese growth, reduced European interest rates and trouble in the Ukraine and middle east, the US dollar’s reputation as a safe haven has grown in stature in recent months. Positive economic data from the United States mean that commentators are expecting the Federal Reserve to raise interest rates sooner rather than later in 2015, adding to the appeal of the currency.

With this huge rally in the US dollar, the prospect of another currency such as the Chinese Renminbi taking over as the world’s lead currency looks even more distant in 2014 compared to turmoil of the economic crisis of 2008/2009. With eurozone growth pretty tame if not non existent, the European Central Bank has been forced to resort to a UK/US style bond buying programme to aid liquidity and investment in other asset classes. This has hampered the euro of late and has made the US dollar make significant gains against the eurozone currency since the ECB announcement.

Whether the rise in the US dollar in the last 2 months is sustainable is a big question after weak non-farm payroll numbers last month put into question how quickly the Fed would raise interest rates. In the meantime there’s little sign of investors taking their foot of the gas in buying the green back. An incredible run that’s for sure.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.