Currency Wars Explained

Feb 28, 2013 at 1:44 pm in Fundamental Analysis by Dave

The current financial crisis has been extremely frustrating for almost all of the major global economic regions as five or six years after it started the end still seems elusive. Indeed, in recent months the UK has experienced an unprecedented triple dip recession, Europe is still mired in an environment of generational high unemployment and the US, although recovering, is still not generating the jobs growth that many would like.

Governments around the world have tried literally everything in the economic textbook to boost their economies, but due to the huge public debts that they had accumulated over the last 20 years, they have not been unable to apply the necessary fiscal measures to boost internal demand that traditionally would have been used. In actual fact, many countries have been doing just the reverse and enforcing austerity on their populaces that is simply making things even worse.

Under the current environment, central banks have been substituting the usual fiscal levers of government that would be expected to be applied, and are throwing everything they have on the monetary side at their domestic economies in an increasingly desperate attempt to boost demand and create self sustaining growth. So far this is proving elusive. The use of such monetary policy tools is aimed at boosting GDP through primarily external demand (i.e. exports) at the expense of neighbour countries in what is known in economic literature as beggar thy neighbour policies.

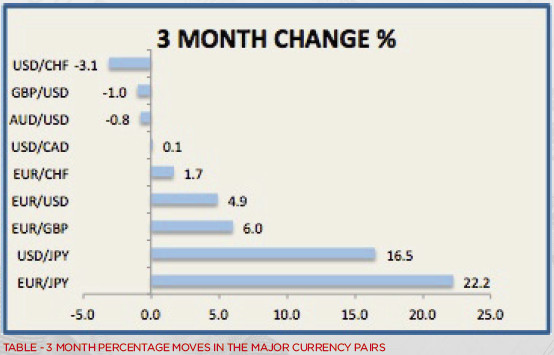

With the Japanese yen devaluing by some 22% against the euro in just three months and with the euro appreciating against pretty much every currency, it is safe to say that a currency war has started in earnest.

The Foundations for a Currency War

A “currency war” is essentially a competitive devaluation of a country’s currency relative to others or against a basket of currencies in an attempt to boost exports (external demand) and so add impetus to that country’s industry. It is, traditionally, the easiest way to become competitive. Instead of cutting wages and jobs as Portugal, Greece, and Ireland (imposed by the Troika) have, countries sometimes try to just lower the value of its currency in order to make its products become more attractive at a price point. It usually works too and creates a new wave of economic growth, albeit at the expense of that countries purchasing power (higher cost imports for example).

This type of economic warfare often results in retaliation by other countries to prevent themselves being negatively affected by those policies. It is thus all too easy to understand how workers in Portugal, Greece, Spain and others inside the Eurozone currently feel, given that they have now endured almost 5 years of extreme austerity measures and now see their efforts thrown through the window due to the euro appreciation…

From Crisis to Currency War

The currency war started in 2008-09, even though at that point the main goal of central banks was simply to try to contain the financial crisis that was just gathering pace rather than trying to influence exchange rates. One way or another, however, monetary policy always influences exchange rates and when it is extremely expansionary, as it is now in most countries, it ends with winners, and losers…

During the last few years, central banks have used monetary easing, lower interest rates, currency floors/caps, capital controls, direct market interventions and even verbal interventions in attempts to fix internal demand problems. The Swiss National Bank, for example, had to directly intervene in the market providing Swiss francs for the excess demand for its currency — an unprecedented measure for this model of fiscal and monetary prudence. The bank imposed a floor on the cross EUR/CHF of 1.20 to avoid excessive appreciation of the Swiss franc and has been accumulating foreign exchange reserves as it sells Swiss francs and buys the respective pair currency in a continuous battle to maintain the peg.

In the US so called “Helicopter” Ben Bernanke has been aggressively expanding the monetary base, buying everything he can lay his hands on, from government bonds to mortgage securities. As yet, he has not intervened directly in the equity market, but give it time..!

The Bank of England has followed the same policy buying the UK’s domestic debt and suppressing gilt yields at 300 year lows. In Japan, central bank intervention is now being taken one step further than others and the independence of the BOJ is actually at stake as Shinzo Abe, the newly minted Japanese Premier, is now adopting a very aggressive stance in favour of material yen devaluation. A policy which, certainly in the very recent past, is proving fruitful as the yen is down 22% and 17% in the last three months against the euro and the US dollar respectively.

Monetary easing in the US has led to many complaints against it from Latin America, and in particular from Brazil which depends heavily on exports to the US. The current US Fed policy has led to the appreciation of many countries’ currencies against the dollar and some of their central banks have been forced to lower interest rates in response. Countries like South Korea and Taiwan are also making loud noises now as they are losing competitiveness against Japan with the current yen devaluation.

Monetary easing in the US has led to many complaints against it from Latin America, and in particular from Brazil which depends heavily on exports to the US. The current US Fed policy has led to the appreciation of many countries’ currencies against the dollar and some of their central banks have been forced to lower interest rates in response. Countries like South Korea and Taiwan are also making loud noises now as they are losing competitiveness against Japan with the current yen devaluation.

Lessons from the Past

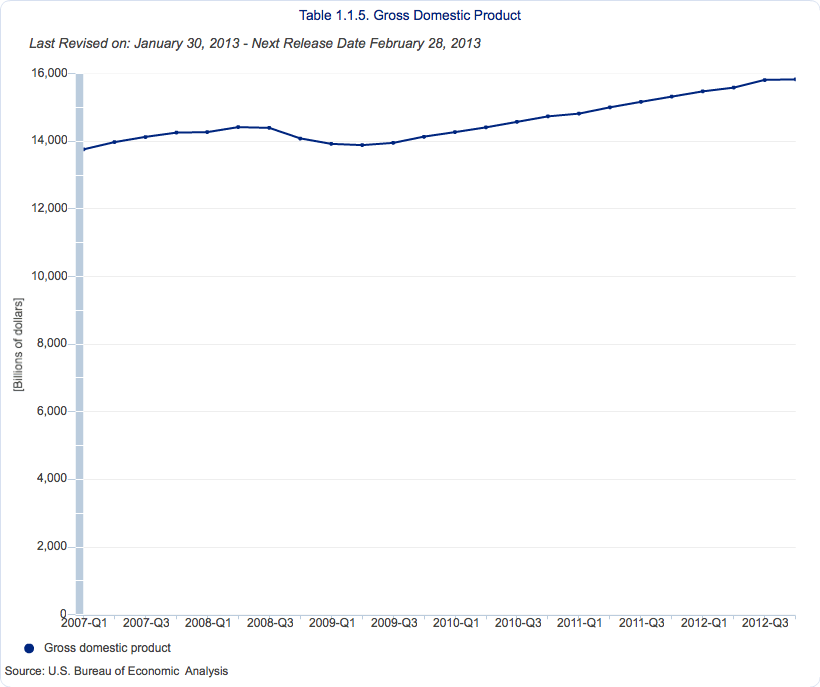

Currency wars have happened in the past, with the best example being just after the Great Depression. In 1931, it was in fact the UK that started a currency war and which culminated with the end of the gold standard in 1936. Following the Depression, and after suffering from rising unemployment and sluggish growth for several years, the UK decided to leave the gold standard for good and so let sterling devalue against other currencies. The measure was very successful for the country as the UK started recovering before other economies. When comparing with the devastation that enveloped the US economy – crater-ing GDP by almost a third – a level very similar to Greece today, the UK just went through a mild recession. Indeed, if we contrast this with the present day, we can see that the US has effectively followed the same path as the UK over the past 80 years. This explains why the US has been recovering in recent years with falling unemployment and nominal GDP now actually back above the level prior to the Great Financial Crisis, whilst those countries still in the mire like Southern Europe are tethered to a de facto gold standard – the strong and resilient euro.

Soon after the UK abandoned the gold standard, Norway and Sweden followed the same path. As time passed, it became apparent to others that the only option left to them in order to create growth in their economies would be to follow the same path as the UK and so the cycle of competitive devaluations was started.

With its own international trade more than halved, the US soon understood that a strong currency wouldn’t help, and in 1936 the gold standard was finally abandoned by the US Fed. Early movers, however, experienced a more muted crisis than the later ones. Ben Bernanke made his name studying the Great Depression and this fact is unlikely to have been lost on him.

And so to the present day, it seems that Japan is indeed on the right path in matching the UK & the US in aggressively devaluing its currency. With an economy that is almost entirely export dependent, who can blame them? At some point, however, the gains from the currency devaluations diminish as domestic purchasing power reduces and monetary policy inevitably moves to a tightening stance to rein in inflation.

The Eurozone, with the Troika firmly in charge, will be the clear loser here in our opinion as they are the only economic bloc in the world that is currently tightening monetary policy and not leaning into the market to suppress the exchange rate value. In this high stakes game it seems the people of Southern Europe have more pain to come courtesy of Ms Merkel and her band of merry austeres..!

Article reproduced from the March 2013 edition of Spread Betting eMagazine