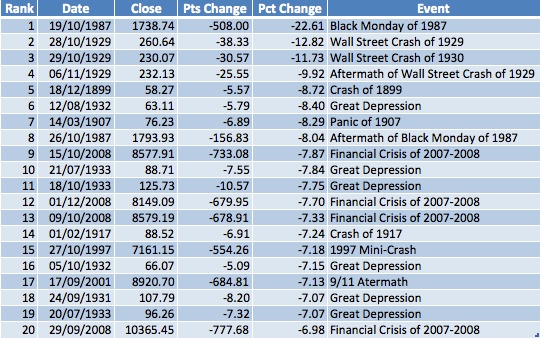

Stock Market Crashes of the last 100 Years

Nov 25, 2012 at 4:24 pm in Fundamental Analysis by Dave

In a special two part piece that will conclude next month we look back at the major stock market crashes of the past 100 years.

Since the creation of the Wall Street Stock Exchange, at the beginning of the 20th century, there have been countless stock market crashes that have ruined the fortunes of many in just a matter of days, hours, or even minutes. Crashes are the result of panic selling associated with poor underlying economic conditions. Although the exact triggers vary widely from crash to crash, most of the time a crash follows speculative stock market bubbles, periods under which people drive share prices up to lofty levels seemingly in thrall to never ending prices and where valuations get pushed way beyond fundamentals. To quote Alan Greenspan: “periods of irrational exuberance”.

A stock market crash differs from a bear market due to its associated accelerated panic selling leading to abrupt and often dramatic price declines in short spaces of time. In what may surprise many, a crash need not necessarily lead to a bear market. Of course, the Wall Street Crash of 1929 lead to a prolonged bear market that took until 1935 for the market to shake off. In contrast, the crash of 1987 was shrugged off in a couple of years and in fact set the scene for the long bull market of the 1990’s.

In this edition of our magazine we will take a look at the Panic of 1901, the Panic of 1907, the Wall Street Crash of 1929 and the Black Monday of 1987. In the next Spread Betting Magazine’s edition we will continue with the little known Friday the 13th mini-crash of 1989, the October 27, 1929 mini-crash, the 9/11 aftermath crash of 2001, the 2008 Great Financial Crisis crash, and finally the 2010 flash crash.

‘Crashes are the result of panic selling associated with poor underlying economic conditions.’

Panic of 1901

The Panic of 1901 originated from a fight to control the U.S. railroads between E.H. Harriman and James J. Hill. Harriman was in control of Union Pacific while Hill was in control of Northern Pacific Railway. To dominate the rail roads of Chicago, Burlington and Quincy, Harriman tried to gain control of Northern Pacific Railway by quietly buying up its shares. Just when he almost achieved his goal, Hill learned of Harriman’s activities and contacted J.P. Morgan who ordered his men to buy every share that they could get their hands on. As a result, Northern Pacific shares rose exponentially and the short sellers faced ruin, having to buy to cover at much inflated prices. In the end, neither Hill nor Harriman were able to accomplish their respective goals and in the end they decided to form a trust — Northern Securities — a company that was prosecuted and convicted under antitrust laws, and finally dissolved in 1904. As a direct consequence of the fight between these two stubborn men, many fortunes of lesser men were ruined in the panic that ensued in the stock market in the wake of the prosecution.

Panic of 1907 (also known as the 1907 Banker’s Panic)

In October 1907, a financial crisis occurred as a consequence of a failed attempt to corner the market of United Copper Company. The failed attempt led to a major failure in the banking system, a run on banks and almost a collapse of the whole banking system (sound familiar?!). The crisis has a name — the Otto Heinze Crisis — a man whose failed attempt to push a single tock price higher almost left the country’s banking system facing bankruptcy. In what was arguably the era of Mr J.P. Morgan — a name that still bestrides global markets today — this venerable banker’s actions allowed the market to avoid meltdown.

Otto Heinze implemented a scheme to drive the price of United Copper Corporation artificially higher. He planned to buy shares and put the short sellers in a situation where they had no other chance as to cover their losses apart from repurchasing shares at a much higher price (such events seem entirely legal today as the hedge funds who shorted Volkswagen shares in recent years found to their cost!).

Heinze’s plan was almost farcically flawed, however, as he lacked one major lynchpin to the plan: he didn’t have the necessary funds to do it! Still, undeterred by this small issue, Heinze decided to go ahead with his plan. He overestimated how much of the company his own family controlled and although he succeeded in part in driving the price up, the short sellers were able to get the necessary shares from other sources instead of the Heinze’s family and so the corner operation failed.

As a result of the failure, the price of United Copper shares dropped substantially and Heinze was in a difficult situation unable to pay his debts. Banks lending money to the scheme suffered runs which spread to other banks and trusts. The third largest trust of New York City — Knickerbocker, capitulated, as people withdrew money from almost every bank and trust. J.P. Morgan’s intervention was crucial. He lent money to banks and convinced other influential people to do the same in an attempt to restore confidence. The effort was magnanimous and he was able to put an end to the liquidity crisis in November 1907. United Copper Company was ruined and never recovered however.

The Stock Market plunged 50% from its peak one year earlier.

The panic occurred during a recession and the negative effects were substantial. Production dropped 11%, the stock market plunged 50% from its peak one year earlier, the unemployment rate rose from 3% to 8% and imports dropped 26% — all because of one man’s greed (again, ring any bells Mr Fred Goodwin?!). Fortunately, positivity came from the crisis. In the aftermath it became obvious something should be done to avoid future runs on the banking system. A commission was created and from its recommendations the Federal Reserve System was borne later in 1913.

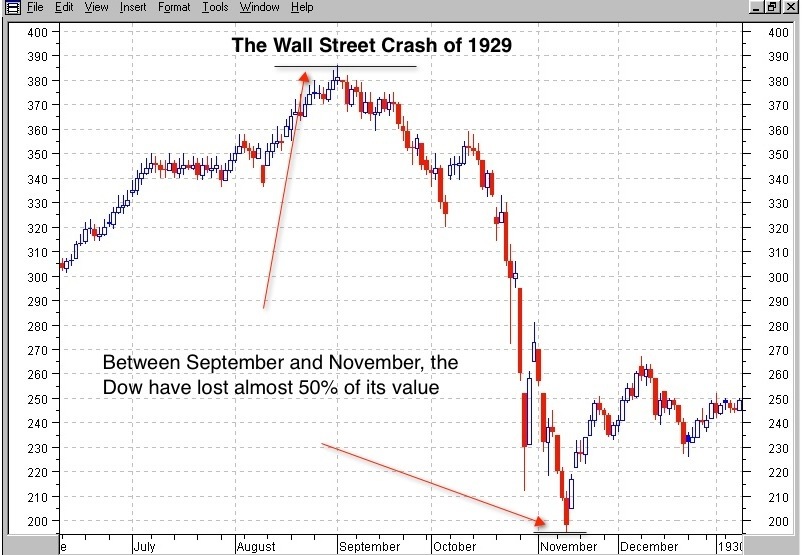

The Great Wall Street Crash of 1929

The Wall Street Crash of 1929, also known as Great Crash or simply Stock Market Crash of 1929, is the Grand-daddy of them all. Quite simply the biggest and most far reaching shakeout in stock market history. In 1987, the stock market experienced a larger drop in a single day but the 1929 crash was much more profound and marked the beginning of an economic downturn that was the worst in America history — The Great Depression.

Right throughout the 20’s, markets had been rising for nine consecutive years. The U.S. economy was emanating confidence as its power and influence was rising on the global stage. Many Americans invested in the stock market with more and more getting sucked on as prices seemed to spiral perpetually higher. People borrowed money and brokers were happy to allow buying on margin (an early precursor to CFD trading and spread betting perhaps?).

In the days preceding October 24, 1929, shares prices suddenly became unstable however. With the P/E ratio on the S&P index sitting above 30, a bubble was already well and truly formed. At the time, however, many attributed the price swings to the prospects for passage of the Smoot-Hawley Tariff Act, an awful piece of law that imposed raising U.S. import tariffs to record levels. The exact reason that led to the sudden decline in shares on October 24 is not known, but panic hit the market and it was driven down 11% just after the open. Several influential bankers called an emergency meeting and decided to buy shares in blue chip companies in an attempt to encourage investors to do the same and so restore trust in the marketplace. It was a success and the market recovered during the session to close just a little under water.

Unfortunately, the press hit the eyes and ears of many during the weekend (recall this was a time of no computers and internet!) and on Monday October 28th, investors tried to sell their shares, many held on margin, en masse. Panic spread and the market lost 13% in what was the second largest daily loss ever at the time. The following day another loss of 12% was registered. Even though the market managed to recover 12% the following day, the damage had already been done. Confidence was shot to bits and many margined players were flushed out. A downtrend of three years was just getting started.

Stock market values dropped an incredible 90% during the ensuing 3 years through to 1932 in what was the worst depression ever — the Great Depression. In just four years, the economy saw unemployment rise from 3% to 25%, international trade halved and many people were ruined. Although many say the crash and the depression that followed were not cause-effect, truth is there is a strong relation. The plunge in the stock market hit confidence in the whole nation and led to the bankruptcy of several banks. Businesses couldn’t get funds from banks and unemployment rose (ever more parallels with the events of recent times eh?). Consumption was severely hit and a process of economic torpor and contraction was put in motion that was only mitigated when President Hoover started the great American rebuilding program.

Even though it is not clear what led to the crash and the subsequent crisis, there are certain factors that were key. First of all, a lesson to learn on valuation. Never buy overvalued shares with the crowd. High P/E ratios illustrated that a bubble had formed and that sooner or later a crash would occur. Second, the Smoot-Hawley Tariff Act was quite simply ruinous. J.P. Morgan, a key man in the prior crashes, almost begged President Hoover to veto the act as he knew it would be disastrous. He was right. The Act played its role in the crash as many countries retaliated against the crazy import tariffs. In 1933, U.S. international trade was an astonishing 50% lower than where it was at the start of 1929. Third, the fallout from the banks de-leveraging only served to accelerate the problem. A system to diminish the effects deriving from liquidity problems should have been in place, but it wasn’t. Amazingly, it took 25 years until 1954 for the Dow to recover its pre-1929 crisis level.

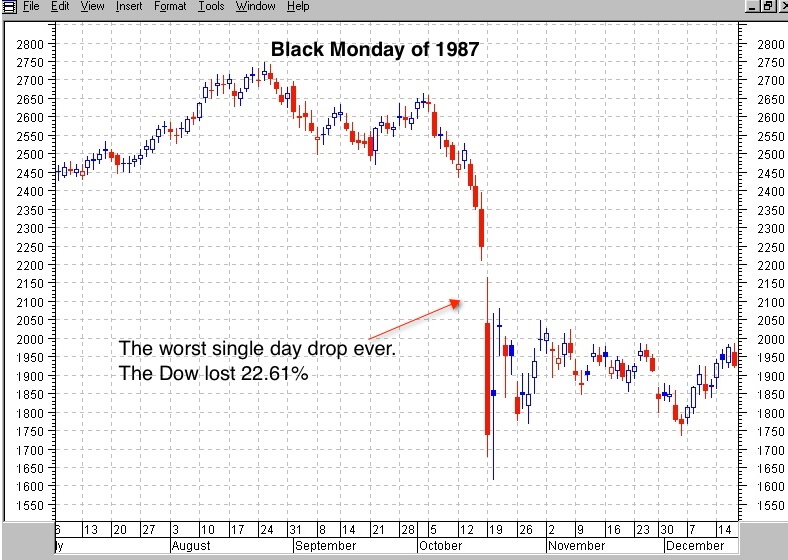

Black Monday of 1987

‘It was the worst single-day drop the Dow ever experienced and to this day still stands losing 508 points which translates into a tub thumping 22.61% drop’

The crash occurred on October 19, 1987 becoming later known as Black Monday. It was the worst single-day drop the Dow ever experienced and to this day still stands, losing 508 points which translates into a tub thumping 22.61% drop. Prior to this single-day loss, there was a warning shot across the bows to investors as the Dow had lost 10% over the prior three sessions. It took almost two years for the index to fully recover from the loss. But, if we contrast this with the twenty five years it took to recover from the 1929 crash, it was nothing. In fact, although being the worst single-day loss, the 1987 crash was relatively mild in terms of its aftermath problems. This time there was no J.P. Morgan to save the banks, but the Federal Reserve System was already in place and doing its job to avoid the spread of problems to the whole economy through slashing interest rates. Its actions were very effective and a painful and prolonged bear market and economic contraction was averted.

Many explanations were advanced in an attempt to explain the catalyst for the sudden break in confidence and to this day, people still debate it. Before the crash happened the Dow rose 65% in the two years that preceded it and the market had just experienced a five year bull period rising 189% since August 1982 as Treasury Bond yields fell dramatically and a “cult of equity” was again getting started. We can see now, however, that the usual ingredients were again in place — investor exuberance, lofty valuations and a prolonged bull run that had manifested complacency amongst the investing populous.

Some people think that computer trading exacerbated the decline. In 1987 computers were developing fast and were being used to automate trading. Some reports say that when the markets started falling, the computers introduced sell orders on every down tick they saw as a direct consequence of what was called “portfolio insurance” and that this amplified the drop. Still, this wasn’t the catalyst. The crash started first in Hong Kong as the market opened Sunday night (UK time) and then spread to Europe and finally to the U.S. in a crescendo right around the globe.

Just ahead of the crash, US legislation was introduced that eliminated the deductibility of interest debt related to corporate takeovers. Again, many have postulated that this was the trigger, but the simple reality is participants were over extended and over exposed and that all that was needed was for a few participants to hit the sell button for the entire pack of dominos to fall. Interestingly however, the stocks that led the decline in the US were those that were the most affected by the legislation.

The final reason pointed out as the cause of the 1987 crash is related to the US’ international trade deficit. A large deficit was announced on October 14 which led the Treasury Secretary to suggest the U.S. dollar may need to fall to bring the current account back into equilibrium. His statement raised fears that foreign investors could pull capital out of dollar-denominated assets, causing a rise in interest rates and a fall in asset prices.

All these reasons may have had their part in the crash, but the presence of an overvalued market is always a key determinant. A P/E ratio at the time of 20 was a warning signal. In writing this piece it caused us to look at any comparable with the present environment. Happily, we find compelling global valuations, particularly in selected Europe, the UK and Japan. All display the same characteristics of investors that are under weight and fatigued with equities and where a largely side-ways market has been experienced over the last 12 years. In short, if history is any guide, the current environment is not one that historically crashes have emanated from.

‘In short, if history is any guide, the current environment is not one that historically crashes have emanated from.’

Article reproduced from the December edition of Spread Betting eMagazine