Examples of Opening Orders

Mar 28, 2012 at 2:58 pm in Orders by

While I almost always apply a stop order to close a trade that goes the wrong way initially, or which allows me to bank some profit when the tide turns on a profitable trade, I’m not so keen on placing orders to open new trades because there are no guarantees on opening orders. But I’m not omnipresent and I can’t have my finger on the right button at the right time all the time, so I’m not totally averse to placing an order to open a position when a particular price is reached and I’m not looking.

Here are a couple of opening orders that triggered for me today; one on Carphone Warehouse and one on Wincanton.

Forgotten Opening Order on Carphone Warehouse

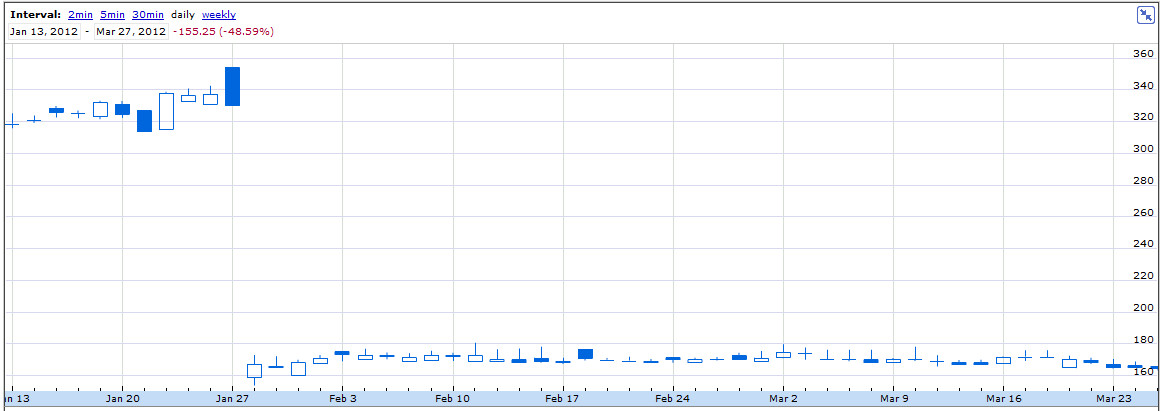

I don’t remember exactly when I placed this order to open, but the chart below helps me remember why I must have done so.

At the end of January the price of Carphone Warehouse shares more than halved. It may have been due to some scandal or other adverse event, or it may simply have been a technical re-pricing as a result of (for example) a share split. At the time I no doubt thought that whatever the reason for the apparent price fall, there was likely to be a positive rebound from the new low price. Because the price had already begun to rebound by the time I had noticed the fall, I must have concluded that I had already “missed out” and therefore I resolved to enter the trade only if I could do so at near the original gapped-down price. So I placed a limit order to buy, and completely forgot about it until it executed today.

At the end of January the price of Carphone Warehouse shares more than halved. It may have been due to some scandal or other adverse event, or it may simply have been a technical re-pricing as a result of (for example) a share split. At the time I no doubt thought that whatever the reason for the apparent price fall, there was likely to be a positive rebound from the new low price. Because the price had already begun to rebound by the time I had noticed the fall, I must have concluded that I had already “missed out” and therefore I resolved to enter the trade only if I could do so at near the original gapped-down price. So I placed a limit order to buy, and completely forgot about it until it executed today.

I’m happy enough that I’m in this trade, but I think there’s a lesson to be learned about reviewing your opening orders (sometimes called ‘working orders’) periodically so that you don’t find yourself opening long-forgotten potential trades left, right, and centre.

Pyramid Opening Order on Wincanton

I do remember why I placed an opening order to buy Wincanton. It’s because I already had a profitable position in play (see below) and I anticipated an opportunity to take a second pyramided position if the price fell back to the potential resistance level established at the time of the recent price dip.

As a result of the order executing today, I now have two positions in Wincanton as indicated on the chart. The key here is that even if both positions subsequently stop out, they will do so for an overall net profit because the profit locked-in by the stop order on the original position is more than the potential loss on the second position.

As a result of the order executing today, I now have two positions in Wincanton as indicated on the chart. The key here is that even if both positions subsequently stop out, they will do so for an overall net profit because the profit locked-in by the stop order on the original position is more than the potential loss on the second position.

Two for the Trading Trail

Although this is not an official trading trail update (because there’s not much to shout about there), I can tell you that these two orders did execute in my trading trail account as well as elsewhere.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.