Trading Trail #32: Back to Break-Even

Feb 3, 2012 at 11:09 am in Trading Diary by

I’m using this week’s trading trail update to mark the point at which my model position trading account got back to break-even; which was at 10:15am this morning (3 February 2012). It was difficult to catch the exact moment, but you can see the proof in the account balance snapshot below.

![]()

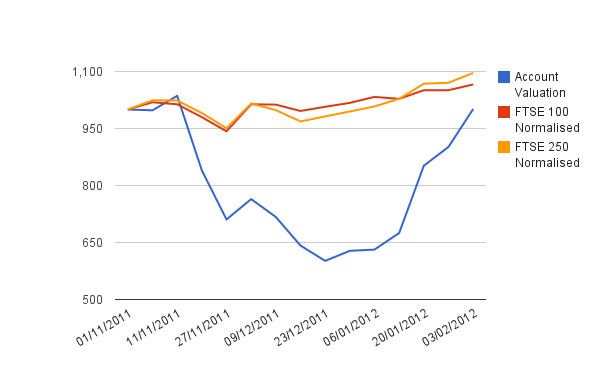

As you can see in the following equity curve, I’m still under-performing the FTSE 100 and FTSE 250 indices, but my equity curve is rising much faster than those indices are.

This equity curve is pretty much as I predicted in my article Trading Trail #24: No Worries — the one in which I drew a handy picture of a catapult being pulled back and ready to shoot a long way. While I have some way to go before I catch up with the FTSEs and make a healthy profit, it shows that this account (and approach) hasn’t turned out to be the dead loss that many observers will have concluded. Now is not the time to be complacent, because we all know that the markets can turn around very quickly. Nor is it time to cash in for my massive £1.38 profit.

You will no doubt be keen to see the latest list of holdings in the account, so here it is, but of course these are not recommendations for you!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.

Hi Tony

with the high level of Margin required how could you possibly open so many positions on a £1000 account??

Please could you explain ?

Hi bamba,

I’m not sure how to interpret your question, because clearly I have managed to open so many positions in this £1000 account. Maybe the answer lies in the fact that almost every position has a stop order, which can reduce the amount of margin required.

Tony.

Hi Tony

Thank you for your quick reply. I understand what you mean. and if you do not mind what is your average stop loss (POINTS).

Just a rough guide

In this account the initial stop distance is usually 10 points or £10, and I let the stop distance widen as a price rises before starting to trail the stop. You can find more information about my stop order policies in my “Stop Orders” and “Position Trading” books.

Just going through your book now ) STOP ORDERS…..will be updating this post as i go