Trading Trail #29: IG Index gets better and better!

Jan 6, 2012 at 7:23 pm in Trading Diary by

Despite holding accounts with most of the spread betting companies, I came rather late to the IG Index party. I think that somewhere along the line — don’’t ask me how — I confused it with CMC Markets, which, at least in its Nat West Index white label incarnation, i didn’t like very much. So I had steered clear of IG Index until I reviewed their Android app.

I have to say that I have been nothing but impressed by IG Index since I started using them. As I alluded in my previous article, they offer what is perhaps the best spread betting account for longer-term spread bettors (and short-term ones too).

Today another feature of the IG Index spread betting platform caught my eye. I had placed an ‘exploratory’ £0.2-per-point long trade on UniCredit (a bombed-out Italian bank) at a price of 393.39, with an entirely separate order to sell £0.1-per-point (i.e. half) at 404. I’m telling you this because when I subsequently reviewed the UniCredit chart I discovered my opening trade and partial-closing order nicely illustrated as shown below.

This is really nice, it’s something I’ve not seen on any of the other spread betting platforms, and you can correct me if I’m wrong.

In case you’re wondering, soon after placing this trade, the sell order did execute when the price jumped up to 404, but it opened an additional short position rather than part-closing my original long position as would happen on most other platforms. I just need to figure out why.

The price turned so positive (see below, and it got even better later) that I was also able to neutralise the risk on my residual position by raising the stop order to break-even at 393.60.

These charts are all the more impressive because yoo can trade directly from them; and amending existing orders is simply a matter of dragging the red line on the chart to a different price level. You can close an existing position, or add a stop order limit with a click of the mouse.

Not on the Trading Trail

I’ve styled this article as a “Trading Trail” article because it demonstrates a spread betting facility in the context of a real-life trade that I only just put in play. Unfortunately it won’t count as part of the official “Trading Trail” final score because its outside of my Capital Spreads account. If ever I start a new Trading Trail real-life trading run, IG Index will be my first choice trading vehicle.

On the Trading Trail

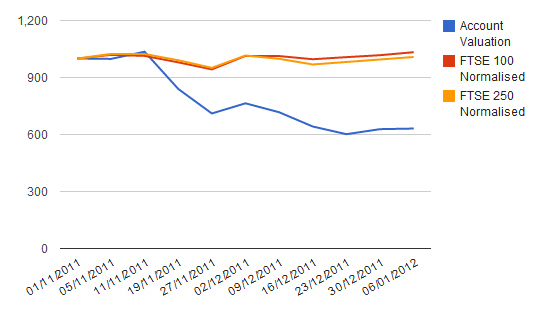

Meanwhile on the Trading Trail itself, the account value as ticked up very slightly from last week’s figure to now stand at £631.35. It had been as high as £675 mid-week.

The latest equity curve looks like this, so I’m currently bumping along the bottom… or what I hope to be the bottom:

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.