Trading Trail #3: A Short Opening Order

Nov 3, 2011 at 5:12 pm in Trading Diary by

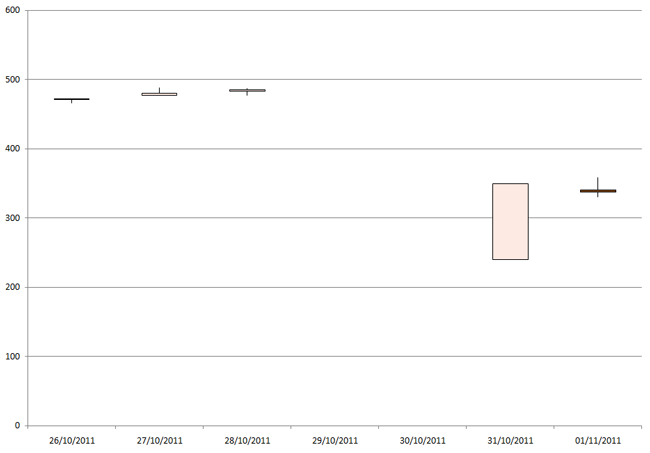

I didn’t tell you at the time, but on Wednesday of this week I created an opening order to sell Homeserve at £1-per-point if the price nudged up to 351p. This is remarkable for two reasons:

- It was an opening order to be executed sometime in the future if my desired price level is reached, rather than a real time opening trade.

- It was a potential short position, and I don’t have any of those yet in this account.

I created this order not only to keep you amused with something a little different, but also because I thought it more likely in the medium term that the price would fall back to the previous gapped-down price of about 250p than to rise back up to the pre-gap price of 500p.

The only fly in the ointment was that the at-the-time market price of ~341p wouldn’t allow me to stay within my “£10 risk per bet” money management criteria with my intended stop level being 20 points away at 361p. If the price edges up to 351p, I’ll be in (short); and I have my opening order is still in in case it does. But opening orders can be risky, so I won’t be making a habit of it.

Stop Press: Since I placed the order, the price has been falling without first rising to my target entry price. So I was ‘right’ about which way the price would go (i.e. down) but I’m not benefiting from it. Never mind, it’s better to let this one go than to have gone in with too much risk.

Today’s Trades

Today I established a new long £1-per-point (of course) position in Aviva, which is a favourite stock over at The Motley Fool (UK). My entry price was 316.1p and my protective stop order was placed initially at 307p then trailed to break-even during the day.

My Stop-Out List prompted me to buy Xchanging at 66.9p compared with a last stop-out price of 70p. The new stop order is at 61p.

Mothercare had gone onto my Stop-Out List yesterday at 157p, and today I re-purchased it at a lower price of 154.1… with a stop order at 149p.

The fact that its price is a mere fraction of its 2007 high price prompted me to buy Capital & Regional at 34.8p with a stop order at 21p.

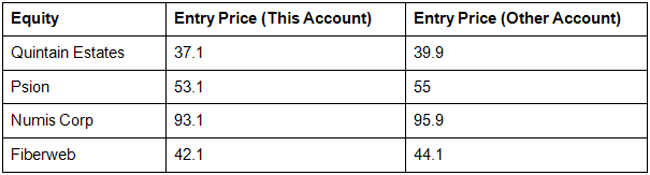

I also established new positions in the following stocks, which are stocks that are currently showing a loss in another spread betting account. The table shows my entry prices in this account compared with my entry prices in the other account.

In effect I have averaged down here by increasing my overall positions across the two accounts now that these stocks are ‘even better value’! You will know that averaging down a falling stock is one sure way to the poor house, so you might wonder why I’ve done it.

I’ll tell you tomorrow.

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.