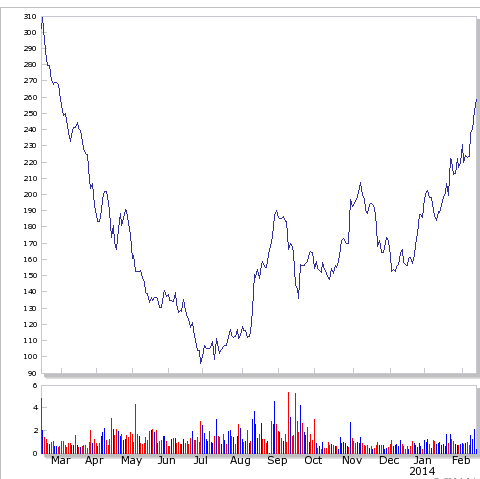

African Barrick Gold – what a turnaround story!

Feb 13, 2014 at 11:03 am in General Trading by contrarianuk

Last summer I had some fun and games trying to trade gold miner, African Barrick Gold (ABG), and most of it rather unsuccesfully as its shares fell off a cliff. In June 2013 they went down below £1 and right now they are £2.60, an incredible recovery as a new management team has put in place new cost cutting measures to offset a weak gold price to boost profitability. In the last month alone they have risen 35%, despite the gold price still languishing at $1288 a troy ounce. The company’s operations in Tanzania, where most of African Barrick’s mines are located, were hit in 2013 due to a combination of illegal mining, strikes and electricity shortages.

Gold hit $1,924 an ounce in September 2011 but dropped to $1,202 by the end of 2013 a fall of 28%, the first loss in the yellow metal since the year 2000 and the biggest fall since 1981.

ABG is 75% owney by Canadian company, Barrick Gold which has had plenty of problems of its own to deal with. In November Barrick Gold announced a $2.9 billion fundraising to help pay down its $15.4 billion debt together with the indefinite suspension of its flagship Chilean Pascua-Lama project. Pascua-Lama as one of the world’s largest gold and silver resources with nearly 18 million ounces of proven and probable gold reserves and 676m ounces of silver. The decision followed a $5.1 billion impairment charge taken in August on the $8.5 billion project (up from an initial budget of $3 billion).

In July African Barrick Gold announced a $701m first-half loss after writing down the value of some assets as a result of the weak gold price and earlier this month its full year figures revealed a 3.9 million ounce reduction in its total reserve base to 12.7 million ounces. Total impairment charges of $823 million for 2013 led to a net loss of $781 million despite earnings of $106 million. Total cash was $282 million as of the end of 2013 down from a year before. Cash costs per ounce were $827 down 12% versus 2012 and all in sustaining costs were $1362 down 14% on 2012. 649, 742 ounces were produced last year, up 7% year on year.

In August 2013, a new CEO, Brad Gordon took over from Greg Hawkins after a series of blunders left investors reeling and the share price languishing at all time lows. Gordon, a former mining engineer, was chief executive of Intrepid Mines, a Canada and Australia-listed precious metals explorer with its main operations in Indonesia. He previously worked at Placer Dome before it was acquired by Barrick Gold, African Barrick’s main shareholder, in 2006.

Gordon has got stuck into making ABG’s three Tanzanian mines more profitable with the Bulyanhulu mine the focus of his efforts. The company is aiming to cut costs by 19% in 2014.

With current all in sustaining costs per ounce at $1362, the focus on cost reduction particularly at Bulyamhulu is much needed. Total operational savings of $129 million in 2013 against a target of $100 million and capital spending reductions of $58 million are commendable but given Tanzanian governement pressure on maintaining head count and wages things are going to be tougher this year for the management team. The plan is for ABG to cut headcount at their corporate offices by 52% by end of 2014 following an $18 million of savings last year. Exploration costs fell $25 million in 2013.

The company sees production of 650,000 to 690,000 ounces in 2014 with cash cost per ounce at $740-790 per ounce, down 10% versus 2013. All in sustaining costs are forecast to drop to $1100-1175 per ounce, down 19% versus 2013 assuming $100 million of capital expenditure hoped to be $100 million lower this year.

The recovery in African Barrick’s share price from the depths of the summer of 2013 truly phenomental for those lucky shareholders who had the nerve to buy before the management team changes. Now Brad Gordon really has his work cut out to maintain the share price and investor sentiment with everything relying on the gold price (which for now is pretty stable) and cost savings in Tanzania. An amazing turn around for this FTSE 250 company! Will it last if gold slips to $1000 an ounce and that’s a big if. A fantastic contrarian buy a few months back that was for sure and gutted I missed it!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.