FTSE volatility high as commodity prices ebb and flow

Jan 15, 2015 at 10:52 am in General Trading by contrarianuk

The FTSE 100 is having another roller coaster day as an initial surge on the back of the 150 point drop yesterday faded as once again Brent Crude fell back 3% to $48.38. The index is currently down 40 points at 6,341 after rising as high as 6,478 early in the session.

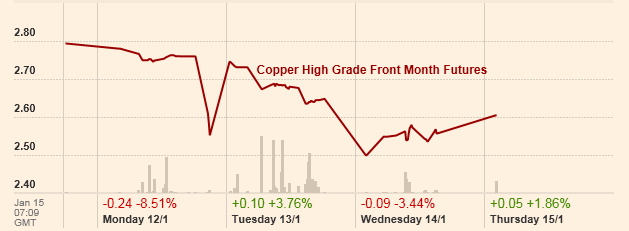

Yesterday’s fall in Copper to a 6 year low of $5,378 a tonne spooked investors and helped drive down the miners heavily including Glencore which fell over 9% and BHP Billiton which dropped 5%. The metal has fallen 11% in value in 2015 after a 14% fall in 2014.

With the heavy falls in Iron Ore and Oil over the last few months, the drop in Copper prices is unwelcome as the metal was seen as a relatively safe haven in the commodity space given robust buying by China and its widespread use in industrial applications. Pure play copper miners with high costs such as Kaz Minerals fell sharply yesterday and the company is down yet another 5.5% to 161p today. Julian Jessop, chief global economist with Capital Economics, wrote in a note Wednesday that copper’s move doesn’t really break with trend, given most industrial metals prices have been weakening for several years. He said investor panic and speculative selling more than anything likely took hold as copper breached that key $6,000-an-ounce level.

After yesterday’s rally in oil with Nymex and Brent crude’s gains of 5.6% and 4.5%, respectively, some were calling a bottom but it appears not. Citi Futures strategist Timothy Evans wrote: “Without some significant bullish fundamental surprise like a change in OPEC policy, we think the market will have difficulty making a sustained price recovery, and Wednesday’s advance was really quite minor in terms of the larger context. And the advance for Nymex crude in particular may have had more to do with “short-covering related to Wednesday’s option expiration and book-squaring ahead of Tuesday’s February futures expiry” .

The commodity super cycle of old seems to be under real pressure right now. Where commodity prices go, the FTSE 100 follows given its large weighting in miners and energy stocks. Global equity prices seem to be out of kilter with the rout in commodities, the big question is will this continue? Just like in 1999 and 2008 will falling commodity prices pre-empt a big equity sell off?

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.