Giant Gorgon LNG project is one huge monster

Dec 16, 2013 at 4:07 pm in General Trading by contrarianuk

Last week Chevron has revealed the cost of its massive Gorgon LNG (Liquefied Natural Gas) project in the north west of Western Australia has increased for a second time, to the staggering figure of $54 billion. That’s right, billions not million! Makes the investment of most companies look pretty tame doesn’t it but it illustrates the scale of ambitions in LNG that many of the global oil and gas majors have right now. But these projects just like many of the giant mining schemes are proving a short term financial headache, despite their long term attractiveness.

Chevron’s total global LNG production, including that from another Australian plant being built called Wheatstone and a newly opened development in Angola, is expected to double to the oil-equivalent of 460,000 barrels per day (boepd) in 2017.

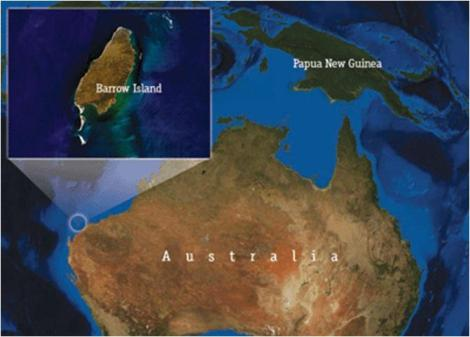

Gorgon is among around $190 billion worth of LNG projects under way in Australia which have suffered due to rising costs and technical problems. Chevron has blamed the high Australian dollar, rising wages, low productivity, weather delays and the logistical challenges of building a gas plant on Barrow Island, a Class A nature reserve as the major reasons for the delays and cost overruns.

The company originally estimated the project would cost $11 billion in 2003, $16 billion in 2007, $37 billion in 2009, that increased to $52 billion a in 2012. Chevron also pushed back the target of first gas at the project to mid 2015.

The Gorgon gas project is a natural gas project in Western Australia, involving the development of the Greater Gorgon gas fields and a liquefied natural gas (LNG) plant on Barrow Island. It is located about 130 kilometres (81 miles) off Australian coast, in waters 200 metres (660 ft) deep.

“Greater Gorgon” refers to a grouping of several gas fields, including Gorgon, Chandon, Geryon, Orthrus, Maenad, Eurytion, Urania, Chrysaor, Dionysus, Jansz/Io, and West Tryal Rocks, situated in the Barrow sub-basin of the Carnarvon Basin.

The Gorgon and Jansz-Io gas fields, 200 kilometres (120 mi) from the coast are said to contain 35.3 trillion cubic feet (1,000×109 m3) of natural gas and may have a lifespan of 60 years.

More than 200 exploration wells have been drilled in the Barrow sub-basin over the past 35 years, including West Tryal Rocks in 1972, and Spar in 1976 – both discovered by West Australian Petroleum (WAPET). WAPET was the operator on behalf of various joint ventures comprising Chevron, Texaco, Shell and Ampolex (the exploration division of Ampol). Chevron and Texaco merged in 2001, Mobil took over Ampolex, and later merged with Exxon to form ExxonMobil. In 2000, Chevron became the operator of all WAPET’s petroleum assets.

WAPET discovered Gorgon in 1981 with the drilling of the Gorgon 1 well. Later discoveries included Chrysaor (1994) and Dionysus (1996). The Jansz-Io gas accumulation, discovered in January 2000, contains an estimated 566 billion cubic meters of recoverable reserves.

The project received preliminary environmental approvals from the West Australian government in September 2007 and from the Federal Minister for the Environment in the following month. Final environmental approval was received from the state government on 11 August 2009. On 26 August 2009, the Federal Environment Minister announced that the expanded project on Barrow Island had been given conditional environmental approval.

The project is being developed by the Gorgon Joint Venture: Chevron Australia (a subsidiary of Chevron) (47% share and project operator)

Shell Development Australia (a subsidiary of Royal Dutch Shell) (25%)

Mobil Australia Resources (a subsidiary of Exxon Mobil) (25%)

Osaka Gas (1.25%)

Tokyo Gas (1%)

Chubu Electric Power (0.417%)

Using initially 18 wells, gas will be delivered via subsea gathering systems and pipelines to the north-west coast of Barrow Island, then via an underground pipeline system to gas treatment and liquefaction facilities on the island’s south-east coast. The plant will consist of 3 liquefied natural gas (LNG) trains, each capable of producing a nominal capacity of five million tonnes per annum (MTPA).

Carbon dioxide (CO2), which comprises around 15% of the raw gas stream, will be stripped out then injected into formations deep below the island. This forms a very large carbon capture and storage project, with 3.4 to 4 million tonnes of CO2 planned to be stored each year.

LNG and condensate, initially stored in onshore tanks, will be offloaded from a 2100m jetty onto LNG carriers and oil tankers. Natural gas for domestic use will be exported by a 70 km subsea pipeline to the mainland.

Chevron Australia has executed Sale and Purchase Agreements (SPAs) with Osaka Gas (1.375Mtpa for 25 years and 1.25 percent equity in the Gorgon Project), Tokyo Gas (1.1Mtpa for 25 years and 1 percent equity in the Gorgon Project), Chubu Electric Power (1.44Mtpa for 25 years and 0.417 percent equity in the Gorgon Project), GS Caltex of South Korea (0.25Mtpa for 20 years), Nippon Oil Corporation (0.3 Mtpa for 15 years) and Kyushu Electric (0.3 Mtpa for up to 20 years).

An Australian subsidiary of ExxonMobil has signed long-term sales and purchase agreements with Petronet LNG Limited of India and PetroChina International Company Limited for the supply of LNG from the Gorgon Project. The agreement with Petronet LNG is for the supply of approximately 1.5 Mtpa of LNG over a 20-year term while the agreement with PetroChina is for the supply of approximately 2.25 Mtpa over a 20-year term. Together, these two sales and purchase agreements commit the ExxonMobil subsidiary’s share of LNG from the 15 Mtpa Gorgon LNG Project.

Under the provisions of the Barrow Island Act (2003), the joint venturers are required to reserve 2000 petajoules of gas for delivery into the domestic market.

IMPORTANT

The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.