Potential Salamander Energy deal shows there is still M&A potential in oil sector

Oct 27, 2014 at 2:44 pm in General Trading by contrarianuk

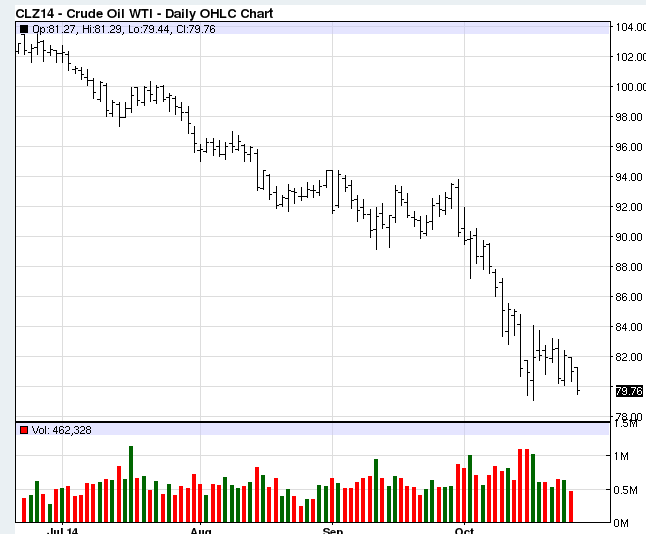

With oil prices falling again today following predictions from Goldman Sachs that Brent Crude in quarter one 2015 would trade at $85 compared with previous forecasts of $100 and WTI US crude would trade at $75 rather than $85 it was time for yet another sell off in energy stocks. Tullow Oil was down 2.5% to 482p, BP was down 1% to 428p and Shell fell 1% to 2264p. Goldman said that said production outside OPEC countries was expected to accelerate, led by Brazil and drilling in the Gulf of Mexico with the end of extensive deep water maintenance following BP’s 2010 Macondo disaster and demand has only averaged 630,000 barrels per day year-on-year so far, less than half Goldman’s initial forecast for 2014. Non OPEC-production outside the U.S. lower 48 states is forecast to increase by 412,000 barrels per day this year, 573,000 bpd in 2015 and 505,000 bpd in 2016.

The Goldman report contrasted with comments by Mohammed al-Mady, chief executive of the Saudi Arabian petrochemicals producer Sabic, at the weekend who believed that the decline in oil would prove temporary as population growth and global growth increases higher consumption and supports prices in the longer term.

Salamander Energy share price 2013-2014

Salamander Energy share price 2013-2014

But there was one glimmer of good news from the oil sector with Asian focused Salamander Energy announcing that two parties could be potentially interesting in acquiring it perhaps showing that will oil stock prices this depressed there is still hope for corporate M&A activity.

Salamander is up 18% to 95p after earlier climbing as high as 100p after a report in the Sunday Times yesterday reported interest in buying it from Ophir Energy, the UK listed company, and Cepsa, the Spanish group, were today confirmed in an RNS. A conditional offer has been recieved from Ophir Energy. This marks the second potential deal for Ophir after a potential offer for Premier Oil was rebuffed in the summer. Today the company said that “The proposals from Ophir and the CEPSA Consortium are subject to a number of conditions, including due diligence and the receipt of a unanimous recommendation from the Board of Salamander. The Company is currently in discussions with both Ophir and the CEPSA Consortium in relation to their respective proposals. However, there can be no certainty that any offer will be forthcoming, or as to the terms of any such offer. Accordingly, shareholders are advised to take no action at this time.”

Salamander’s shares have fallen heavily this year as it earlier announced plans to put itself up for sale then finally agreed a $280 million with Sona Petroleum to sell a stake in its offshore fields in the Gulf of Thailand. It said today that “Contrary to remarks in the press, the SONA Transaction remains on track for completion before the end of 2014, in keeping with the timetable and strategy previously outlined. The $280 million of proceeds from the SONA Transaction would strengthen Salamander’s balance sheet and would place the Company in a strong position to benefit from opportunities arising from the current market conditions.”

With prices of so many small and mid caps oil stocks totally bombed out in recent weeks with the oil price falling from as high as $113 to $84, the potential Salamander Energy deal shows that those with deep pockets and looking to replenish reserves or buy ongoing production are still on the look out for cheap deals. The likes of Premier Oil, Cairn Energy, Afren, Ithaca Energy must be on someone’s shopping list if prices continue to fall as they are now.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.