Randgold Resources reassures investors with solid third quarter results

Nov 6, 2014 at 3:43 pm in General Trading by contrarianuk

With the price of gold dropping heavily in recent weeks and currently trading at $1147, investors in sub-Saharan African focused and LSE/Nasdaq gold miner Randgold Resources Limited were relieved to see the company’s third quarter results and drove the shares up 8% on the news to £40.70.

Mark Bristow, chief executive pointed out that cash costs for production were one of the lowest in the industry at $692 per ounce (down 1% versus the prior quarter), meaning that even if gold stays at these levels or even goes below $1000 an ounce the business would still be profitable.

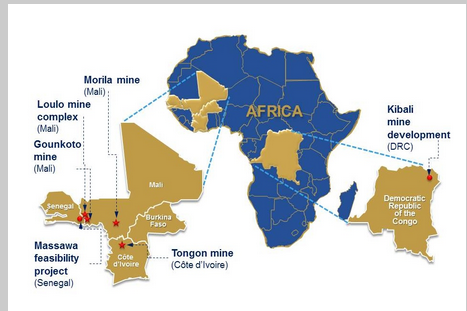

Major discoveries to date for the company include the 7.5Moz Morila deposit in southern Mali, the 7Moz Yalea deposit and the 5.5Moz Gounkoto deposit, both in western Mali, the 4Moz Tongon deposit in the Côte d’Ivoire and the 3Moz Massawa deposit in eastern Senegal. In 2009, the company acquired a 45% interest in the Kibali project in the Democratic Republic of Congo (DRC), which at 12Moz of mineral reserves is one of the largest gold deposits in Africa with production starting at the mine in late 2013 and being one of the key interests for Randgold with a target output of 650,000 ounces per year.

Results for the three months to September, showed production of 299,320 ounces, up 8% on the previous quarter. Production for the first nine months of the year was up 37% on the comparable period in 2013. Earnings per share increased by 11% to $0.63 quarter on quarter but profit was affected by foreign exchange adjustments and at $66.0 million was just marginally ahead of the previous quarter. Profit from mining of $172.6 million was up 6% quarter on quarter. By the end of the quarter, Randgold had returned to its debt-free status, having repaid its revolving credit facility. Kibali produced 145 152 ounces in Q3, up on Q2’s 91,137 ounces. Production at the group’s flagship Loulo-Gounkoto complex was 8% down at 160,286 ounces.

With gold prices under pressure as equities continue to rise, things are looking pretty bleak for high cost producers. Fortunately for Randgold, it doesn’t fall into that camp and further production increases at its key mines like Kibali and Loulo-Gounkoto bode well. With the shares down 12% or so in the last year they have fared better than many gold miners and any signs of a strengthening in the gold price should mean a rapid rise in the share price. But with no signs that golds decline is at an end, that may be a medium term aspiration.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.