Sentiment on the turn in bruised oil and gas sector?

May 12, 2014 at 2:51 pm in General Trading by contrarianuk

The FTSE 350 oil and gas producers index has had a good last few weeks after a series of M&A deals involving the likes of Heritage Oil and the Qatari’s as well as Glencore and Chad focused Caracal Energy.

The FT today highlighted the new found interest in small/mid cap oil and gas space with the significant disconnect between EV (Enterprise value) and reserves. The EV/2P ratio is a measure used to value oil and gas companies. The enterprise value reflects the company’s total value and is calculated as market capitalisation plus debt, minority interest and preferred shares, minus total cash and cash equivalents. Proven and probable (2P) refers to oil and gas reserves which are proven or probably likely to be recovered as determined by third party auditors following a series of appraisal wells on an oil field following the initial discovery.

Many companies listed in the UK look cheap on the EV/2P ratio based on historical norms e.g. Premier Oil, Ophir Energy, Xcite Energy, Rockhopper Exploration, Hurricane Energy (though the latter two companies have contingent not proven resources).

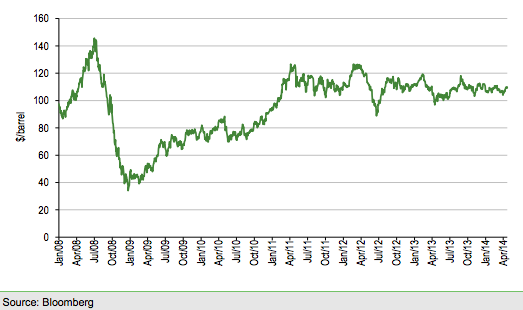

What’s more the price of Brent Crude looks remarkably robust, trading in a relatively narrow range over the past few months despite the Ukraine crisis, and rising production from non-conventional sources in the United States from areas such as the Bakken.

The FT article at “UK oil exploration: Drill bid? Energy returns to an unloved sector” is as follows:

During the wet and dreary winter, UK-listed oil exploration companies were unloved. The stocks traded well below net asset value per share. Many major oil companies – Shell, BG, BP and others – were selling off upstream assets. Now it is Spring, and love is in the air. Oil companies themselves have taken notice of the undervalued barrels and made merger approaches. The value of announced deals among E&Ps outside North America has jumped 44 per cent in US dollar terms this year so far, using Bloomberg data.

Some of the hoped-for deals – such as Glencore’s acquisition of Chad-based Caracal Energy – look like they will go through. Others have excited investors without the benefit of consummation. Two informal proposals of marriage by the cash needy Ophir Energy for cash rich Premier Oil have produced no negotiations. But the approaches – and the exit of boss Simon Lockett – have helped Premier’s share rise by a third in the past three months.

A number of listed E&Ps still trade relatively cheaply, as Bank of America notes. Consider the ratio of enterprise value to proved, probable and contingent oil reserves. Half of UK E&P’s trade below $6 per barrel, far below the $14 Glencore paid for Caracal. Indeed, on an EV per barrel basis the sector is at its cheapest in five years. Not every barrel returns the same amount of profit. Nevertheless, bigger oil companies clearly will bargain hunt at these prices, and investors have noticed.

Over the past three months the FTSE 350 oil producers’ index is up 12 per cent. Compare that to the FTSE All Share which managed just a third of that. Yet some of these oil specialists have lagged behind. Afren, for example, will nearly double its oil production by end 2016 and can self-fund its drilling program. It deserves a premium rating. The season of love may last a bit longer.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.