So far we have looked at the entry and exit and the difference between the two expressed as a number of points (share pence) gained or lost. Why? Because that is the most important measure of the success of your trading.

The point is that spread trading allows you to 'bet' at an amount per point and only you can decide how much. If you have a position at £1 per point and make 50 points gain, you will have made £50. If you take exactly the same position but at £10 per point you will make £500 and the same position at £50 per point would produce a profit of £2,500. Of course, you might have the courage (and bank balance) to go £200 per point and make £10,000 from the same trade but remember that the potential risk (loss) also increases with your position size. We will return to look at real £ risk in a later chapter.

How much you can bet on a position is governed by the minimum the trading company will allow and your account credit (called margin). Small on-line positions for as little as £1 or 50p per point allow you to test your strategy and your expertise while risking very small sums of money. The only word of warning I will give you is that sometimes, when you trade very small position sizes, you do not take it seriously enough and therefore do not truly test your trading ability.

You can bet (trade) from as little as 50p or £1 per point.

Let's just return to our two earlier examples and imagine we had placed £10 per point on each.

In the 'long' example in Figure 2, if we had gone long £10 per point on Ultraframe we would have made:

£10 x 58.5 points = £585.00.

In the 'short' example in Figure 4, if we had gone short £10 per point on British Airways we would have made:

£10 x 26 points = £260.00.

But before we go on, I must point out the reverse side of the story.

What happens if you are WRONG!

Spread trading is great when you are right and making money but you must always remember that losses can mount up very quickly as well. I will return to this later when we talk about stop losses but let's take a look at one example for you to clearly understand why care must be taken before you enter a trade.

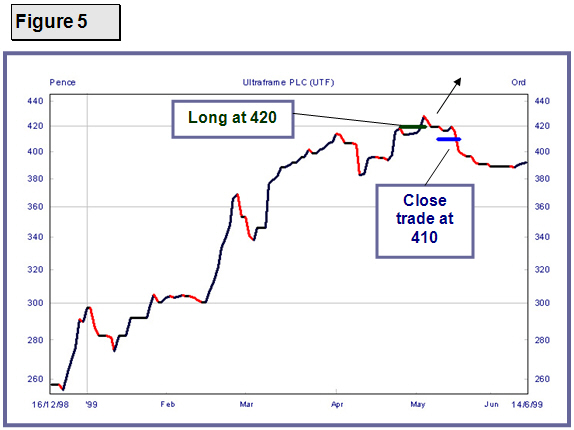

The example below is Ultraframe again and we saw earlier how we could make money by getting it right. Now let's say that on the chart in Figure 5 you believed that the share price would continue to go up and so you went long at 420 (£4.20) market mid price.

The spread was 416 to 424.5 (spread of 8.5 as before).

|

You open the trade long (expect the price to rise) at 424.5 (buy price) and bet £10 per point.

The trade then goes against you and you decide that you will get out and cut your losses at 410 market mid price. Bear in mind that the market price has only dropped 10p from your opening position.

The spread at the close was 406 to 414.5 (still a spread of 8.5) so you sell at 406 (sell price).

Your loss is 424.5 - 406 = 18.5 points x £10 per point = £185.00

That may seem like a big loss when the price has only gone 10p in the wrong direction but remember, this time you have to pay the spread as well. Before, the spread was simply subtracted from your profits.

Losses include the spread, which can be tough to take!

So here are a few more tips!

TIPS -:The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.