Spinning Tops and Long Bodies

Spinning Tops

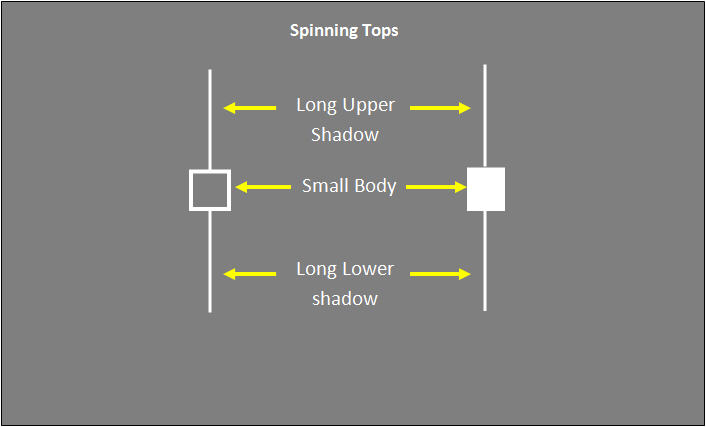

Spinning tops are another variation of a candle. They tend to represent a period of indecision in the market. As can be seen there is a very small body showing not much difference between the opening and closing price during that period and yet very long upper and lower shadows. Here we can see the range of prices for the period is very large but the opening and closing prices are nearly the same denoting the market sentiment is very uncertain at that stage hence maybe a trader will tend to hold off on a trading decision until certainty returns to the market.

A spinning top candlestick has a short real body, which can be either white or black, and long upper and lower wicks or shadows. In a similar way to the idea of the Doji, these can often represent indecision, and may be interpreted as a trend losing steam. When deciding if the body is particularly short, you should compare it to adjacent candlesticks. If all the trading has been with relatively short bodies, then the spinning top must be much shorter.

An extreme spinning top, with long shadows both above and below is called a high wave candle. This is a more significant indicator of indecision, as both buyers and sellers have explored a large price range during the trading, only to settle back near the starting point. It’s a good indication of a confused market, and a confused market is open to changing direction.

Long Bodies

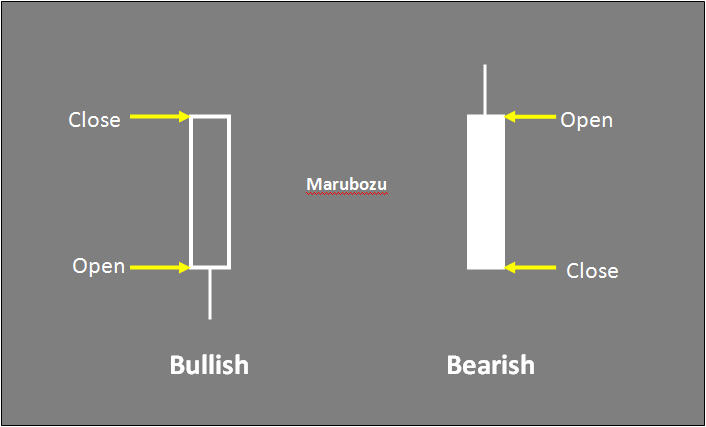

As you may guess from the foregoing, when a candle has a long body then it is considered to be a strong indication of the market. A long white body shows strong bullish interest, while the long black body is definitely bearish. When the body is the whole candlestick, with no shadows above or below, then it is called a Marubozu.

Once again, when deciding whether a body is long or not you should compare the candle body to the surrounding candles. To qualify as long, you should look for two or three times the length of the previous bodies. The long body is particularly significant if it pushes through an established support or resistance line.

Marubozu Candle

Marubozu candles are particularly strong directional candles. With a very full body and only one shadow being either upper or lower. The left candle indicates it closes on the high indicating a bullish sentiment in the market opposed to the candle on the right where the close is on the low indicating a very bearish sentiment. These Marubozu candles do not occur all that frequently and should always be noted. Many traders can use this as an indicator to a trend change also by backing up their decision with MACD crossovers and moving average trend breaks.

Join the discussion