Pepperstone Broker Review

Pepperstone Limited was established in 2010 when it established an operation in Australia. Pepperstone launched in the UK in 2016 and today they have many European clients. The European operation trades in accordance with the regulatory principles set down by the European Securities and Markets Authority and the UK FCA.

- Pepperstone Group Limited is regulated by ASIC Australia with AFSL number 414530.

- Pepperstone Limited is regulated by the UK Financial Conduct Authority, number 684312, located at: 70 Gracechurch Street, London EC3V 0HR United Kingdom.

Disclaimer: Spread betting and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Minimum deposit: No minimum deposit required but Pepperstone recommend a minimum of $500/£500.

Deposits and Withdrawals: Pepperstone accepts these forms of payments: bank wires, credit and debit cards, Skrill, Neteller, Union Pay, BPay, POLi, and PayPal. Deposits should be instant, except for bank wires, which can take a few days. Withdrawal fees are only applicable to bank wires, although third-party charges may apply. However, it is worth noting that there are no withdrawal fees for European clients.

Markets: The range of markets you can trade is good and includes many forex currency pairs, a number of major global stock indexes, individual US equities (on their MT5 platform), 6 precious metal pairs, oil and gas commodities, and 4 cryptocurrency CFDs.

| Spot Forex | 62 currency pairs. | AUDUSD, AUDNZD, CADJPY, EURUSD, EURGBP, GBPAUD, GBPCHF, NZDUSD, USDCAD, USDCHF, USDJPY and more… |

| Share CFDs | 62 Share CFDs. | Alibaba, Amazon, Bank of America, Goldman Sachs, IBM, Netflix, Pfizer, Tesla, WalMart and more… |

| Index CFDs | 14 Index CFDs. | Australian 200, Germany 30, Japan 225, UK 100, US 500, US Tech 100, US Wall Street 30, Hong Kong 50, China 50 and more… |

| Cash contracts | 13 Spot and Commodity Futures. | Gold, Silver, Platinum, Cotton, Sugar, Cocoa, Brent Crude Oil, Natural Gas and more… |

| Cryptocurrencies | 5 Cryptocurrency CFDs. | Bitcoin, Bitcoin Cash, Ethereum, Dash and Litecoin. |

Excluded Countries:

Pepperstone Australia USA, Europe, UK

Pepperstone UK: USA, Belgium

Is Pepperstone an ECN/STP trader or market maker? This broker is authorized to be a market maker but opted not to apply this model. Pepperstone claim not to run any proprietary trading book. They source their pricing from external Liquidity Providers via an electronoic communication network, and this pricing is passed on to clients without a dealing desk intervention.

Account Types

Spreads on Pepperstone’s popular MetaTrader 4 platform are arguably variable, with quotes sourced from around 22 major banks and electronic crossing networks.

This provider offers three types of accounts, namely Standard and Razor as well as a Spread Betting Option (only available to UK & Ireland Residents).

These accounts consist of the following:

Standard Accounts

- Competitive liquidity.

- Interbank spreads from 1.0 pips.

- No commission.

- No minimum deposit requirement.

Pepperstone Razor Accounts

- Deep Interbank Liquidity.

- EAs Allowed.

- Hedging Allowed.

- Min Account Opening Balance GBP200 or equivalent.

- Trading from 0.01 lots.

- Raw Spread.

- Scalping Allowed.

Spread Betting

- Spread Betting on MT4 or MT5.

- Spread Betting on cTrader.

The Razor account comes with institutional-grade spreads with no markups, meaning that the average EUR/USD spread is between 0 – 0.3 pips. Instead, they charge a commission of $5.58 (GBP4.59) per 100k units round turn for EU clients and $4.74 (AU$7) for international clients. Pepperstone recommends that you choose this account if you prefer scalping and algorithmic trading.

The Standard account, on the other hand, comes with slightly higher spreads due to the markup. The typical EUR/USD spread here is between 1 – 1.3 pips. This is still competitive, however, and as there’s no commission, it’s a good choice for beginner traders.

| Account Type: | Razor | Standard | Swap-free |

| Institutional Grade Spreads | Yes, with no markups | Yes | Yes |

| Average EUR/USD Spread | 0.0 – 0.3 pips | 1.0 – 1.3 pips | 1.0 – 1.3 pips |

| Commission | From GBP6.59 round turn 100k traded | $0 | $0 |

| Rollover Swaps | Refer to trading platform | Refer to trading platform | Fixed admin fee |

| Best For: | Scalpers/Algorithmic Traders | New Traders | Religious Traders (Islamic) |

Standard vs Razor Accounts (Spreads Comparison)

| Forex Pair: | Razor Min Spread | Razor Average Spread | Standard Min Spread | Standard Average Spread |

| EURGBP | 0 | 0.41 | 1 | 1.41 |

| GBPUSD | 0 | 0.44 | 1 | 1.44 |

| USDJPY | 0 | 0.25 | 1 | 1.25 |

| EURUSD | 0 | 0.13 | 1 | 1.13 |

Strictly speaking there is no minimum deposit although a minimum of £200 is recommended. EU accounts offer a leverage of up to 30:1. International accounts (non-EU) have a minimum deposit requirement of AUD 200 and leverage is capped to 500:1.

Pepperstone also makes available a demo account that allows you to trade with $50,000 in dummy funds. It expires after 30 days, that should be sufficient time for you to familiarise yourself with the platform.

This provider also offers social trading. However, they don’t have their own platform and instead work with a variety of partners like ZuluTrade, Myfxbook, RoboX, Mirror Trader, Duplitrade and Pelican.

Pepperstone Fees

Pepperstone charges commissions to clients with Razor accounts, but with other accounts, the provider receives its compensation through the bid/ask spread.

Overnight Funding Fees: This overnight Pepperstone fee (or credit) is either added to or subtracted from a trader’s account when a position remains open past a certain period of time. Traders can obtain information on overnight funding rates on the Pepperstone MT4 platform. To view rates, simply select: View > Market Watch Right Click on “Market Watch” and select Symbols Choose the currency pair you wish to check and select Properties.

Platform and Tools

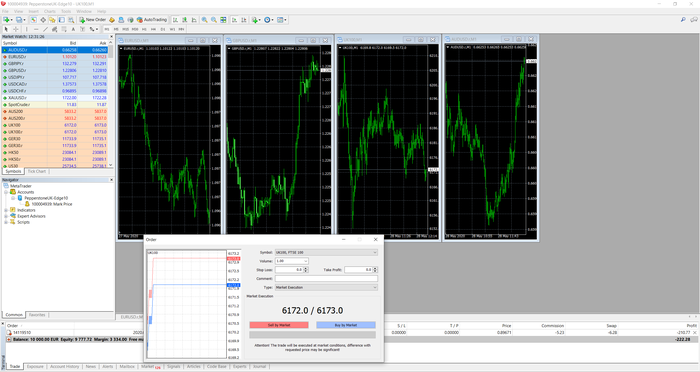

Pepperstone offers all the three leading trading platforms; MetaTrader 4 (MT4), the MetaTrader 5 (MT5) and the cTrader platforms. All three platforms are available for desktops and mobile devices. The MetaTrader 5 was developed and marketed as an improvement on MT4, yet many traders and brokers alike still seem to prefer the earlier technology, because MT4’s indicators and Expert Advisors (EA) are not supported on the MetaTrader 5 platform. As regards the cTrader platform, it is custom-made for use with ECN brokerages and has a simple user-friendly interface.

MetaTrader 4

The MT4 trading platform is definitely the most popular forex trading platform in the industry by far. It should be familiar to traders that have traded with the many other MT4 brokers. The main screen has the familiar layout:

The trading platform also supports a number of advanced tools as well as Expert Advisors (EAs) and MQL scripting. These advanced features means that the platform is highly regarded by beginners and experienced traders alike. Other key features of the MT4 platform include the following:

- Ability to customise the MT4 platform anyway you wish.

- 85+ built in Technical indicators.

- Various order types are supported.

- Live news feeds.

- Multiple timeframes for the charts.

- Build and run the expert advisors using MQL4.

- Customizable user interface in different languages.

On the less positive site the MT4 platform lacks two-step login authentication and the design of the platform is looking a bit dated now. You can use only basic order types; you won’t find more sophisticated orders such as ‘one cancels the other’ but market, limit and stop orders are available.

MetaTrader 5

The MT5 platform is built on the success of its predecessor, the MT4 platform. It comes with updated trading abilities such as faster trade processing times and gives its user the ability to hedge their trading positions. In short, the MT5 comes with more trading tools to take traders to the next level. Some of the main features of the MT5 platform include:

- Advanced customization of the trading screen.

- Large array of technical indicators.

- Supports 21 different time frames.

- Built-in Economic Calendar.

- Support 3rd party tools such as Autochartist and Smart Trader Tools.

- Use and code easily with MQL5.

- Lots of inbuilt indicators and faster processing.

- One click trading as well as advanced pending orders.

The MT5 platform has been given a cold reception by many traders as it lacks a backward-compatibility with the prevalent MT4. However, it does come with an improved user-interface and faster trade processing times.

cTrader Platform

Apart from the MT4 and MT5 platforms, Pepperstone also offer the cTrader platform developed by Spotware. This platform offers advanced charting and trading features, and the structure is similar to the MetaTrader platform. This trading platform is available in a web browser or a software download and it also works on Android and iOS devices.

The cTrader platform itself has a very clean and visually appealing layout:

The cTrader trading platforms offer a number of features including:

- Advanced features to control order fills and functionality.

- Large range of in-built trading indicators.

- Detailed trade analysis to identify patterns in trader behaviour, as well as educational videos within the platform.

The available functions include the ability to place all basic orders including market, limit, stop-loss, stop limit, trailing stop orders. This combines with an intuitive design and user-friendly interface which supports the capability to customize multiple settings and views within the platform. You can also easily setup alerts so you are notified if a market hits a certain level.

cTrader also provides the environment of institutional trading for those looking for advanced functionality.

- Order fills with advanced cTrader features & Control slippage.

- Access FIX API.

- Code in C# with cTrader Automate.

Additional Tools and Features

Clients trading with Pepperstone are offered a unique set of additional products to aid in their trading. These include:

- AutoChartist: This software can be downloaded into Pepperstone’s MetaTrader platform where traders can use Market Scanners, Probability filters, advanced Risk Management tools, additional Technical indicators and a Volatility Analysis function.

- Smart Trader Tools: This package is intended for Pepperstone’s MetaTrader 4 and 5 platforms offers advanced expert advisors such as a Correlation Matrix, Sentiment Trader and a Trade Simulator, as well as advanced trading indicators such as Pivot Points, Renko and support and resistance Gravity lines.

- API Trading: Pepperstone supports automated trading via API offering benefits such as increased ability to see depth of market and the advantage of accessing multiple liquidity providers.

- Multi-terminal free download for MetaTrader 4:. A management tool that lets you place trades across multiple MetaTrader 4 accounts at the same time.

Education is also supplied by Pepperstone and it is presented in the form of written content, videos, and webinars. Pepperstone offers a series of articles on trading forex and CFD trading, a course on the basics of forex trading, and a video MetaTrader 4 course. Market research analysts from Pepperstone also publish regular updates and market commentary in both written and video formats. They also publish a week ahead report, an economic calendar and a chart of the day.

Pros and Cons of Pepperstone

Advantages

- Regulation is taken seriously. Pepperstone is FCA and ASIC regulated.

- Competitive spreads and commissions.

- High-speed execution.

- Choice of trading platforms.

- AutoChartist and Smart Trader Tools packages free for users.

- Wide range of trading platforms across all operating systems.

- AutoChartist and Smart Trader Tools packages free for users.

Disadvantages

- A limited number of markets and instruments to trade.

- Conditional orders on the MetaTrader platforms lack sophistication.

- Demo account remains valid only for 30 days.

Verdict: Spreads, trading costs and execution times are as low as you’re going to get from retail brokers. Pepperstone offer spread betting on MT4, MT5 and Ctrader which is something that very few brokers offer. And also reassuring they’re regulated by 2 heavyweights the ASIC and FCA. Sign up with Pepperstone here

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.