Spread Bet on Whitbread Shares

It has been a trend in the last decade for large companies to reinvent themselves, sometimes abandoning their previous lines of business in an attempt to pursue a more lucrative future. So it is with Whitbread PLC. Anyone who knew of Whitbread’s business in the 20th, 19th, or even 18th centuries (the company was established in 1742) would readily label them as brewers and sellers of alcoholic beverages. In 2001 Whitbread decided to sell all its breweries and brewing interests to InBev, called Interbrew at that time.

Now Whitbread is a global hotel, restaurant, and coffee shop business head-quartered in Dunstable, in the UK. It was first listed on the London Stock Exchange in 1948. The original brewery building in London still survives, but brewing ceased in 1976 and it now serves as a conference venue, owned by an investment firm.

The brands now run by Whitbread include the Premier Inn hotel chain, mainly based in the UK with over 600 hotels, the Table Table restaurant chain which is at more than 100 locations in the UK, and the Beefeater grill with more than 130 locations.

More in line with traditional Whitbread activities, the Brewers Fayre is a pub/restaurant brand. Whitbread also owns Costa Coffee, with more than 1000 outlets around the world, in 25 countries.

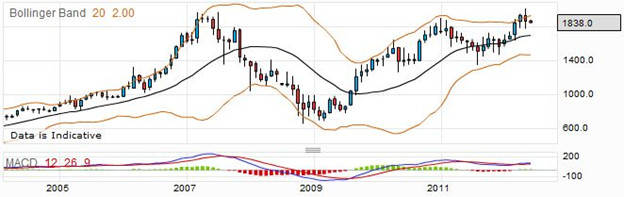

The monthly price chart reveals how much this industry was hit by the global economic recession. From a high of nearly 2000 in 2007, the price dropped down to below 700 in two years. Whitbread has recently just managed to overtake its previous high, and the growth since 2009 has been strong, with some retracements.

Spread Betting: Whitbread Rolling Daily

The current price for a rolling daily bet on Whitbread is 1838.2 – 1841.8. Whitbread is heavily focused on the hotel and dining sectors, and its coffee houses, Costa Coffee, are doing well. After looking at the technical analysis, you may decide that the stock is going to increase in price, and place a buy bet for £2.50 per point on this stock.

Should you prove to be correct, and the price go up, then you may be tempted to end your spread trade and collect your profits when the quotation is 1972.6 – 1976.0. To work out how much you have won, you first figure out the point difference. As it was a long bet, the starting price was the buying price of 1841.8 and the ending price was the selling price of 1972.6. That means you have gained 1972.6 minus 1841.8 points, which is 130.8 points. With a stake of £2.50 per point, you won £327.

Sometimes bets fail. No one is correct all the time, and you must learn to accept your failures while trying to reduce their frequency and effect. Perhaps the price fell to 1743.6 – 1746.2, and you closed your spread trade and accepted your loss. The starting price was 1841.8, as before, and this time the closing price was 1743.6. The difference is 98.2 points, which for your chosen stake works out to a loss of £245.50.

Another way that you may use to close a losing trade is to set a stoploss order when you open your bet. With this, you do not need to be watching the market, and your spread betting company will close your spread bet if it goes too far into the red. You might have found yourself out of the losing bet when the price was 1785.3 – 1788.7 if you had set a stoploss order. In this case, you would have lost 1841.8 less 1785.3 points, or 56.3 points on this trade. That would amount to a loss of £141.25.

Whitbread Quarterly Futures Bet

Having abandoned its brewing activities early in this century, Whitbread now concentrates on hotels and restaurants. You may think that this rationalization means that the shares will increase in value over the next few weeks or months, and decide to place a futures style bet. Perhaps you would stake £4 per point on a long bet. The current quote for the far quarter is 1845.6 – 1857.6.

As it is a long bet, it is placed at the buying price of 1857.6. Should it work out, you might decide to finish the bet and collect your reward when the price goes up to 1987.3 – 1999.3. While your bet has been open, the price has gone up from a buying price of 1857.6 to a selling price of 1987.3, which is a difference of 129.7 points. In this instance, you would have won £518.80.

On the other hand, the price might have fallen after you placed your bet and you would need to close the bet quickly to minimize your losses. Perhaps you closed the bet when the price went down to 1752.5 – 1764.5. The starting price was 1857.6, and the finishing price was 1752.5. That means you lost 105.1 points. At £4 per point, that amounts to a loss of £420.40.

Many traders decide to use stop loss orders on their bets, hoping that they will not be needed. The stop loss order only works when your bet is losing, but it literally stops your loss when a certain price is reached, by closing your bet. Perhaps with a stoploss order on this bet you would find that the trade was ended when the quote was 1802.1 – 1811.5. In this instance, the starting price was 1857.6, as before, and the finishing price was 1802.1, for a point difference of 55.5. With a stake of £4 per point, you would have lost £222.

Join the discussion