Spread Bet on Meggitt | Trade Meggitt Shares

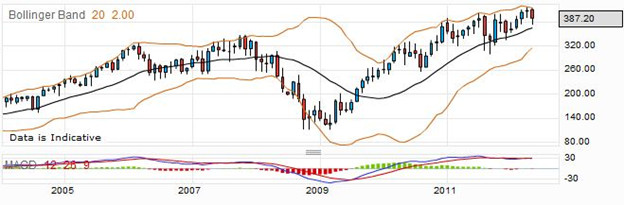

Meggitt plc is an engineering business head-quartered in Dorset, at Bournemouth Airport. It is an international aerospace, defense, and electronics group, and has been performing very well in the recovery from the global economic crisis of 2008, as can be seen in the chart below.

Although it took a big hit, as did many companies, you can see that it has more than regained the lost ground and is continuing upwards. It is involved in many different types of engineering, including defence, and this may explain its progress.

The group is organized into three main sections, aerospace, defence, and electronics. The aerospace division which operates from the facility in Simi Valley, California, includes Safety Systems with fire, heat, and smoke detection and necessary controllers. Aerospace also includes fluid controls and braking systems. The electronics part of the group includes many different sensing systems that go under different names such as Endevco, Vibro-meter, etc.

The company started in the 1940s in Halifax, when it was known as Willson Lathes. It went public as early as 1947, and took over another engineering business in the West Country which was called Meggitt. In 1986 it took on Bestobell, another well-known engineering business. Expansion continued in the 21st century, with the addition of Dunlop Standard Aerospace Group, K and F Industries, and Pacific Scientific Aerospace.

The monthly price chart above shows a narrowing of the Bollinger Bands, which usually means that the price is due to break out, either up or down. The price has been steadily tracking the top band, with the central moving average line providing support, and it would be reasonable to keep an eye on its progress, looking for any sign of the breakout. You should not place a trade from a monthly chart alone, but this gives an overall picture which you can use in conjunction with daily price charts for your entry.

How to Spread Bet on Meggitt Shares: Rolling Daily

Meggitt is an English engineering company with worldwide offices, and it has been acting strongly since recovering from the global economic crisis. The current price for a rolling daily spread bet is 387.41 – 388.19. If you want to bet on the price falling, you could place a wager at the selling price of 387.41, betting £9 per point for a move downwards. Given the current performance, you are looking for a retracement, and should have technical analysis to support your trade.

Assuming you have this one right, the price could drop to 336.23 – 337.01, and you might decide to close your spread trade and capture your profits. The trade would close at the selling price of 337.01, and taking this away from the opening price of 387.41 you have gained 50.40 points. When you multiply this by £9, you will see that your winnings are £453.60.

If the price does not retrace yet, and you see it steadily climbing, you may have to decide to close your losing trade to cut your losses. Say you watch it go up to 421.63 – 422.33, and then make the decision to end the trade. You have lost 422.33 minus 387.41 points, or 34.92 points. This would cost you £314.28.

It can be difficult to keep track of all your spread bets, so to ensure that losing bets are closed in a timely manner many traders use stop loss orders. Placed at the time you open the trade, this tells your spread betting broker to close a losing bet once it reaches a certain level. Perhaps in this case, it would end your spread bet when the price had risen to 412.32 – 413.05. Working out how much you have lost this time, the spread bet was closed at a price of 413.05, 25.64 points up from the opening price. 25.64 x £9 gives you a total loss of £230.76.

Meggitt Futures Style Bet

Meggitt is an engineering company that is doing well in the aerospace and defence sectors. The current quote for a mid-quarter futures style spread bet is 387.73 – 390.84. You may decide, having looked at the technical analysis, that its current up-trend will continue in the midterm, and place a long or buy bet for £12 per point at the buying price of 390.84.

If you are correct, the price could go up to 416.72 – 419.56, and you could close your spread trade to collect your winnings. You placed a long bet, so the starting price was 390.84, and the closing price was at the selling level of 416.72. The difference between these two numbers is 25.88 points. Multiplying by £12, you have won £310.56.

Fairly frequently the price will go in the wrong direction, and you will have to face closing the spread bet for a loss, rather than hanging on and losing more. Say the price fell to 365.90 – 368.67, you could close your spread trade and accept your loss. You have lost 390.84-365.90, or 24.94 points. For your size of bet, this amounts to £299.28.

As an alternative, many spread traders use a stop loss order to take them out of a losing trade. The stop loss order is normally placed when you take out the initial bet, and it tells your spread betting company to close the trade at the market price once the price has reached a certain level that you specify. If you had done that in this case, you might have found that the trade was closed earlier and that you lost less. Perhaps the stop loss order would trigger when the price fell to 374.66 – 377.43. Your starting price was 390.84, and the trade closed at 374.66, a loss of 16.18 points. That amounts to a loss of £194.16.

Join the discussion