Selling Climax

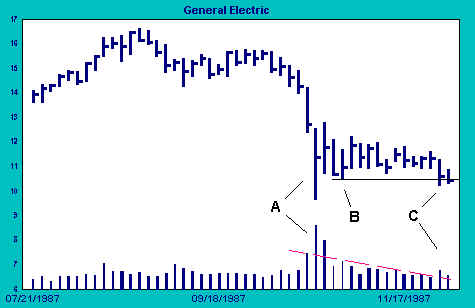

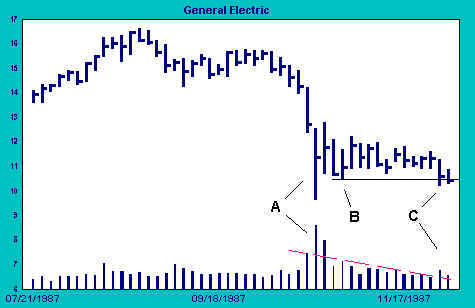

The selling climax at point A in the chart below is typical; volume increases dramatically as the spread from high to low widens. Such action indicates that panicky sellers are getting out at any price.

With prices at immediate and substantial discounts, strong hands now hold the bag for cheap stock. Experienced traders know that there will be an opportunity for quick longside profit once selling climaxes. Much of the stock these nimble traders buy during the selling climax is thrown back on the market in the first snap-back rally, and prices sag again to B.

Volume begins to dry up as soon as the panic subsides, but it is too early for us to take a position. This is still a stock for day traders only, who are able to capitalize on wide intra-day swings. Swing traders and position traders, those with a longer time horizon, will wait 1) for trading to calm and 2) to see whether and at what level strong hands support the stock before considering an initial position.

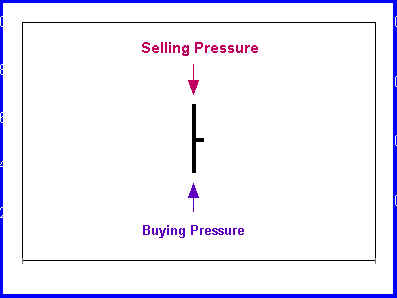

At B, volume increases as spread narrows. Sellers are still actively pushing down on the stock, and the high for the period is below the highs of the previous two periods. But the low at B fails to decline commensurately, indicating that buyers are applying upward pressure near the lows. As a consequence, the high-low spread narrows.

High-low spread compression, particularly on increased volume, indicates that roughly equal buying and selling forces are contending for dominance. Spreads often narrow around market turns, where buyers and sellers are locked in a struggle for control.

As the spread compresses at B, volume picks up. Volume can be viewed, in one of its aspects, as the din of battle. When buyers and sellers are actively engaged, volume increases. The outcome of the battle is evident from the rally immediately following B. Buyers have absorbed supply and have gained temporary control.

We now have an indication of support, the level at which buyers are willing to make a stand. A horizontal line drawn at the low of period B is a line in the sand. It remains to be seen whether this line will hold.

For the next nine periods, trading narrows as volume decreases. After climactic selling, a steady decrease in volume may be bullish evidence that sellers are becoming exhausted and that shares are moving into strong hands.

Accumulation, particularly after a sharp selloff, takes time, so we must be patient. While there are signs of support, there is as yet little evidence that buyers are firmly in control.

At C sellers reassert themselves with an attack on support. Spread widens and volume increases. Buying forces appear to bend under pressure. The high-low spread of the next period narrows, but the stock closes below our support line. As yet, we have not ventured a position.

Join the discussion