The Daily Trading Plan

Why bother with a daily trading plan?

Because trading well is a rational process, and planning is the act of developing a rationale. Without a rationale for one’s trading, several things could happen, all bad. First, without the conviction that comes with having thought things through, you may have trouble pulling the trigger on a trade at the low-risk pivot point; or you may miss the trade altogether because you were not prepared. Second, even if you get on, you may exit too soon, or too late because you have not determined stop loss or profit objective. Third, your trading may dissolve into emotional, reactive trading. To be consistently successful, your trading must be well-reasoned and proactive.

You are unique, and ultimately you will develop a unique trading style depending on the markets you trade, your capital, time available, risk tolerance, the analytical techniques you master and trading horizon. But regardless of style, whether you are an intra-day, swing or position trader, you need to plan your trades and trade your plan.

Because traders’ styles vary widely, there is no single format for structuring your trading plan. Instead of a generalized blueprint, I’ll show you the process I use to develop my own daily trading plan. There are a number of steps, and the procedure may appear cumbersome at first. In reality, it usually takes very little time to update my trading plan, and the written portion often amounts to little more than jotting down a few ticker symbols. The key is to update the plan by increments each night, without fail. As Jimminy Cricket says, “Yard by yard, it’s hard; inch by inch, it’s a cinch.”

Perhaps the most important elements of my plan are the relatively unchanging personal traits and biases which I bring to the process. These include a merely moderate tolerance for risk, a preference for equities, an aversion to thin stocks and impatience with the drudge of day-trading. I am a swing trader who prefers to trade relatively liquid issues. If I were suddenly to begin day-trading commodities or thin stocks, I would be acting out of character and out of control. My trading plan never explicitly excludes such trades because they are implicitly excluded. By knowing myself as a trader, I have become aware of the personal envelope within which I work. My trading plan deals only with trades which fall within that envelope.

What sort of trader are you? What sort of trades are you comfortable with? What sort of trade is outside your plan?

The Planning Process

Here are the logical building blocks for my trading plan, from most general to most specific:

1. What Is the Trend?

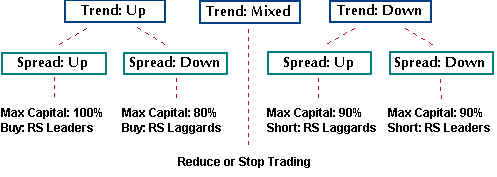

It is my practice in trading to reason from general to particular. That means that I must first come to a decision about the market’s broad trend. I do this by calculating the performance of two groups of stocks, relative strength leaders and RS laggards. If both strong and weak groups are rising above their twenty-day moving average, I want to be long. I will simply pass over stocks which might otherwise present short selling opportunities. If both leaders and laggards are falling and below their twenty-day moving average, I look for stocks to short. A mixed market, one in which leaders and laggards are headed in opposite directions, gives me a chance to rake the leaves or go skiing. I know from experience that I am not clever enough or lucky enough to make money from a mixed, or trendless, market.

2. Is the Spread Rising or Falling?

This important bit of information cuts the market in half for me. If the Spread is rising, I look only at those stocks which have shown superior relative strength over the last twenty weeks. If the trend is up and the Spread is up, I am a buyer of strong stocks. But if the trend is up and the Spread is down, I am looking to buy only laggards breaking out of bases (review Basic Training, Chapter 7).

Shorting is a special case. If the trend is down and the Spread is down–indicating that stocks with a recent history of strength are dropping fastest–I may venture small short positions among stronger issues. But I don’t like shorting strong issues. Not in a twenty-year bull market.

On the other hand, if the trend is down and the Spread is flat or up–indicating either that stocks are dropping indiscriminately (flat Spread) or that weak stocks are falling fastest (rising Spread), I rummage through charts of weak stocks looking for short-sale setups. Shorting a weak stock is like kicking an opponent when he is down. It’s not fair, but it’s safe. And I like it like that.

Once I have determined my strategic position, I look for stocks which match the strategic requirements outlined above. I adjust margin to reflect both my confidence in the individual trade and the strategic odds for success (review Playing the Odds).

These strategic factors change rather slowly. Trends in both prices and the Spread may persist for months. Nevertheless, I recompute them at least twice each week to make sure that I am on firm ground strategically.

3. Other Factors

Options expiration, FOMC meeting, earning reporting season all introduce the potential for disaster. As a rule, I am flat during the first two; fortunately each lasts only one day. Earnings reporting season presents an unusual challenge to technical traders. In the bad old days, earnings news was leaked into the market by degrees, providing a relatively smooth progression from one price level to another. Today, the SEC has put a clamp on leaks. When the news finally hits, it’s not in the market, and prices make quantum changes. That’s a risk I prefer not to take. My trading plan calls for one of three approaches to earnings reporting season: 1) diversify into a relatively large number of small positions; 2) trade stock indexes; or, 3) go to cash.

Each night I review a list of roughly 250 stocks, and maintain point & figure charts on about 100 key issues. P&F entries are made by hand to make the action of these stocks palpable. I stalk issues which are on approach to an important pivot point and keep P&F charts on all likely candidates.

If the daily chart of a candidate shows that an important move is imminent, I check the five-minute chart to confirm the setup. Stocks which make it through this sieve become candidates. Depending on general market conditions, I will either enter overnight orders at the market or monitor the next morning’s intra-day action to determine the best buy or sell point.

4. Profit and Loss Potential

Each position is taken as close to a swing pivot as I can manage in order to reduce risk and maximize potential gain. I expect my trades to work within a relatively short period of time. Generally, I will give a trade from two to five days to begin to work for me, or I exit. For each trade I have determined the next swing objective and the stop loss point beyond which I will no longer carry the trade. I mark these points on my charts. At a minimum, the ratio of potential gain to potential loss must be three to one. Generally I will only enter stop loss orders with my broker if I plan to be away from the market for some time. Otherwise, I monitor my trades during the day. I will act during the day to exit a position at the market if my stop loss point has been reached or if the action of the stock turns negative.

My Trading Plan Strategy

Summary

As you can see, having a trading plan means having a rationale for your trading. That rationale evolves over time, based on your experience of what works. Your trading plan is a daily affirmation of all that you have learned and the foundation of your confidence as a trader.

Join the discussion