We are of the opinion that WMT has been accumulating since at least early 1994. A big upside move may be in the making, and we are tuned to the long side.

Nevertheless, tipped off by WMT’s recent relative weakness, we liquidated our long position. But we are not ready to sell short. To take a short position against our longer-term bullish view would require evidence that strong hands are selling.

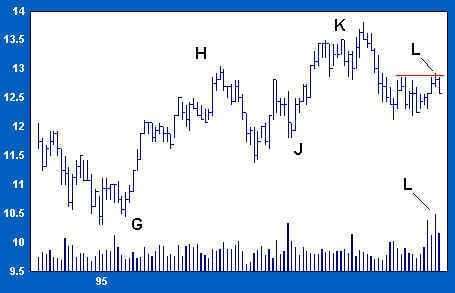

The breakout above 13 1/2 at K induces weak traders to cover shorts and to go long. A quick decline off the highs traps breakout buyers going the wrong way. But volume remains moderate on the decline, and the reaction appears normal. Price consolidates between 12 and 13 as volume eases. These are indications that WMT could be reaccumulating for a short-term rally attempt. But bullish indications are offset by the stock’s persistent relative weakness. Until evidence tilts decisively to one side or the other, we will remain neutral.

The stock does indeed rally, but immediately encounters the heaviest volume in a year on the slight breakout to L. The effort (volume) required is large given the small net advance. The high-low spread compresses. Although price makes a recovery high at L, this is almost certainly a shakeout intended once again to trap break-out buyers and trigger the buy-stops of traders who are short.

The chart of WMT’s relative strength confirms these bearish indications. The relative decline from the high at K has been far more severe than that indicated by nominal price action. RS has broken to a new low, and the nominal recovery high at L (above) is not confirmed.

To be successful over the long run, traders must be flexible enough to follow the evidence of the tape, wherever it leads and without bias. Despite longer-term bullish signs of accumulation, the confluence of negative indications now makes a bearish case for the short- to intermediate-term.

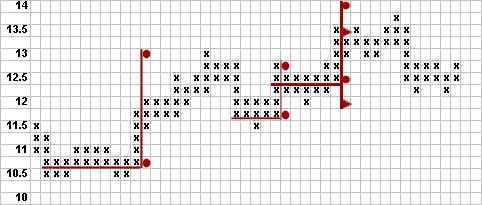

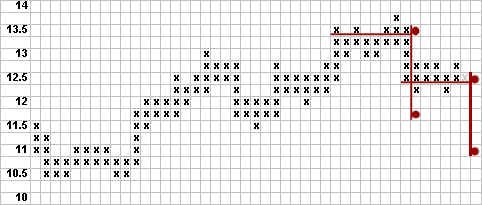

What downside target(s) are reasonable? Point & figure charts again provide an important tool; but we must first decide on the size of the point & figure reversal we should use to construct our chart. Given the low price of WMT, choice of a large reversal might not pick up sufficient detail to be of much use.

For our immediate purpose, we settle on a 1/4 point reversal chart. We prove the validity of this scale by testing earlier counts and the resulting targets. Using one-quarter point reversals seems to have worked well up to this point (see below), a fact which gives us confidence that we have chosen the appropriate scale.

The chart below shows that a first count of 8 columns taken at 13 1/2 gives a downside target of 11 3/4, a level of previous support. A second count across 12 1/2 targets somewhat lower support at 11.

With the stock trading at 12 1/2, a target of 11 offers a profit potential of only 12%, about the minimum required to take the trade. But the near-term technical condition of the stock is weak and the setup for the short-sale is clear. We sell short at the market near L, but keep the size of the trade small.

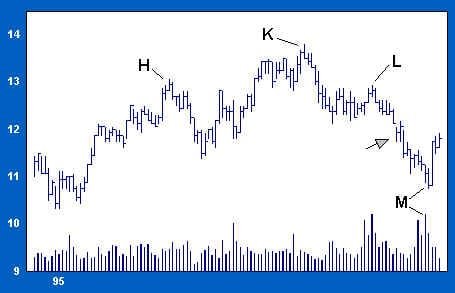

The next chart shows that volume remains moderate on the decline; price is falling easily with little sign of support. At 11 3/4, our first target (see arrow), price gaps down and then recovers briefly. If support were active at this level, volume would increase as buyers become more active. But volume remains quiet. Lacking evidence of more than passing support, we decide to hold our short position.

Price drops through this modest support on widening spread as WMT approaches our next target of 11. On the break to M, volume increases significantly. Our second target (11) has now been met, and high volume is evidence that buyers are actively engaging panicky sellers. We are also at a level which has provided strong support in the past. We are in territory controlled by strong hands.

Based on the evidence of active support at M, we close half of our short position. Before covering the balance of our position, we want to see some indication of a turn. WMT rallies strongly out of the low (M), and we cover the remainder of our short position at the market.