What Can I Trade?

Stocks and shares are one commonly known type of ‘financial instrument’ which can be traded, but there are several others. Some traders are involved with the Forex market, that is buying and selling currencies, and many look to the ‘derivative’ financial instruments so they can multiply the effectiveness of their trading capital. The details will come in later modules, but here’s an outline of what types of financial ‘things’ are available to trade.

By the way, don’t be scared by the name derivative, and the mathematical connotations that it has to Calculus. The financial derivative is just something that ‘derives’ its value from something else. All it means is that you are not buying that something else directly, whether it be a stock or a commodity; what you are trading in just has a relationship to that something else.

What Is Actually Traded?

The Dow Jones is a dollar average of its constituent share values. Today, you can trade futures, options, ETF (Exchange rades Funds), and in the United Kingdom especially, spread betting on the underlying future or the cash market is very popular. The other indices have a similar makeup. The S&P 500 Index is a basket of 500 large cap US shares, the NASDAQ is a basket of almost 4,000 US corporations, weighted towards tech shares.

Also, you can trade ETFs on the index, 2xthe index, even 3x the index – and can trade inverse ETFs (buying when you expect the underlying index to fall). It is quite a zoo out there. But for most traders, trading the Dow Jones (and the emini Dow), the S&P 500 (and the emini), and the FTSE offers enough scope for making profits.

So the Dow is a collection of shares, and each share is a part-ownership of the company. There is nothing “physical” traded here (unlike the corn example). This applies to all the markets we shall discuss here (except gold, I should add).

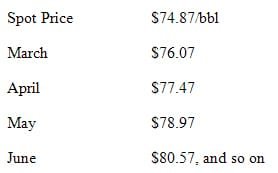

One of the problems with trading futures is that close to settlement day, you need to close out your position. Let’s say we are trading Crude Oil, the futures quotes may look something like this:

We are trading the March contract and it is getting close to delivery (what is called First Notice Day), where you definitely need to close out your position! If you are confident about your position, you could roll it forward to another month, but look at the quotes- they are way up from the March quote. This market is showing a ‘contango’, where the market expects a tighter supply/demand balance in the future. You have a difficult decision to make.

Luckily, when spread betting, you can trade the “rolling” contract, which essentially is like trading in the cash (spot) market and closely follows the spot quotes. There is no need to keep rolling your position over into a new month. Of course, every future month quote must, at settlement day, converge on the current spot price (otherwise there would be a tremendous opportunity to arbitrage, which the city slickers would pounce on, no doubt).

Summary

When we trade any financial market, we are trading a derivative of the underlying index or future. There are many exotic derivatives out there, but we will not concern ourselves with these. We shall focus on trading the well-established and understood markets (those listed above) which have high public participation and large trading volumes. We should avoid thin markets where exaggerated moves often can happen, such as a minor oil exploration company, whose shares depend on the latest drilling results. These kinds of markets appeal to traders/investors who need a high adrenaline rush in their trading as primary motivation. We advise just the opposite in our trading.

We trade the large markets because:

- They respond well to macro economic forces, where the data is mostly in the public domain, and

- They respond well – and directly – to the major ‘sentiment’ indicators (more in later sections)

Trader’s Guide to Building an Effective Trading Strategy

Whether you are building an electronic trading system or fine tuning your strategy as a point-and-click trader, real understanding of the logic and rationale of the strategy is critical to trading with confidence. In this free e-book, internationally recognized trader and educator Daniel Gramza presents the concepts and techniques of his proprietary approach to trading the derivatives markets. He covers how to identify market conditions that lead to the most profitable trades, determine magnitude objectives of different trading techniques, recognize when a trade should become productive, identify when a trade is failing, and decide where to place the risk management stop.

Join the discussion