| Variable Redemption Bond | |

| A bond, the redemption value of which is determined by a variable such as the exchange rate between two different currencies or perhaps the performance of a stock index. | |

| Variation Margin | |

| The amount of money owed by a spread better when holding open positions and they are in a negative position. This is the money you have on deposit with the spread betting company which you are not currently using (sometimes referred to as free equity). More information about Initial and Variation Margins is given here. If a position has moved unfavourably since it was opened, a deposit further to that paid as the initial margin may be required in order to keep the position open (known as a ‘margin call’). Variation margin is also known as ‘maintenance margin’. | |

| Venture Capitalists | |

| Typically a new company starts trading on savings and bank borrowings taken out by the founders. After incorporation, shares are created with the founders owning most of the share capital. However, in most cases a company will need further cash injections to expand and this is where venture capitalists come in place. Venture capitalists buy shares in the company for which in return they get to own a piece of the company and have a say in the board. This primary injection of outside capital is referred to as a first stage investment. The first offering of shares is not usually the last and more shares may be created via rights issues and share placings to allow the company to raise further rounds of finance (which will come from other venture capital fund investors). If the company turns out to be successful it may ultimately decide to list in the market as an IPO. | |

| Volatility | |

|

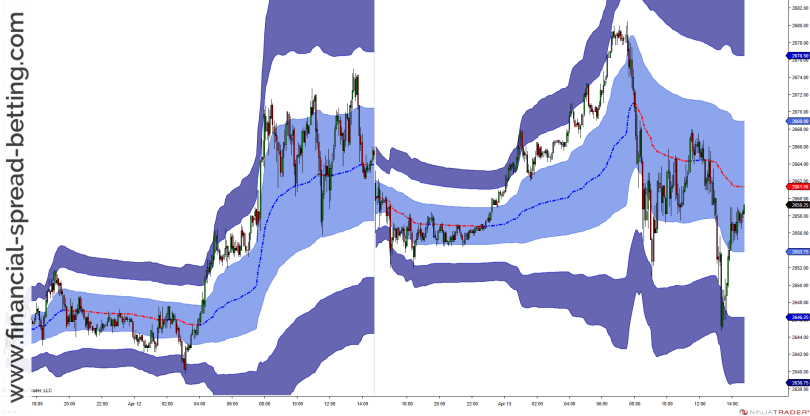

The extent to which a price oscillates. Volatility is a measure of the likelihood of a market or security to rise or fall sharply within a short period of time.

In more technical terms this is relative rate at which the price of a market moves up and down. Volatility is a measure of the propensity of a share, or an index, to go up and down in price. Mathematically, this is expressed as the standard deviation from the average performance. High volatility means higher potential returns, but greater risk of losses. |

|

| Virtual trading | |

| some spreadbetting companies provide a virtual platform that mirrors that real money trading platforms. These virtual accounts are funded with ‘play’ money in order to give the client the opportunity to practice spread betting risk-free. | |

| Volatility | |

| The Market Volatility Index (VIX) is designed to track market volatility as an independent entity and is used as a way to measure investor sentiment. A high VIX rating is considered a sign of negative market sentiment whereas a low VIX rating is considered a sign of positive market sentiment. | |

| Volume | |

| The number of shares traded in a particular security or index on any given day. | |

| VWAP | |

| Volume Weighted Average Price (VWAP) is the average price paid for a particular security or index over a period of time. |