Market still sceptical on Quindell

Oct 13, 2014 at 1:12 pm in AIM by contrarianuk

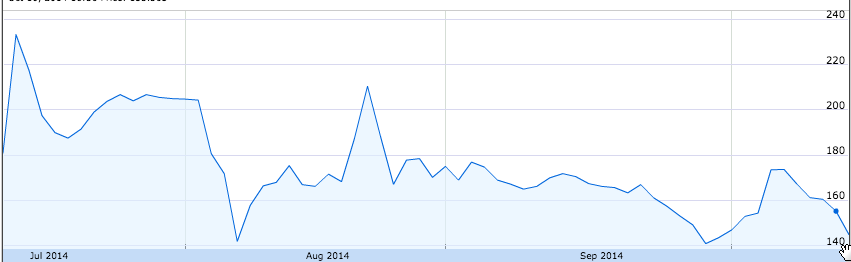

Shares in Quindell Plc (QPP) initially rose 7% today after a trading update for the third quarter of 2014 but are currently down 9%. Short seller Gotham city recently released a twitter tweet saying that “Per Quindell’s trading statement & financial highlights released today, we believe #QPP is behaving as if it is at high risk of bankruptcy.”

Revenue rose 115 percent to about 198 million pounds (about $319 million) for the quarter ended Sept. 30, while adjusted earnings before interest, tax, depreciation and amortization (EBITDA) rose 141 percent. Professional Services sales of c.£177m increasing by 124% (Q3 2013: £ 79.0m). It reported adjusted EBITDA of c.£83m which increased by 141% (Q3 2013: £34.5m) due to Q3 2014 having an increased amount of high margin Digital Solutions revenue and growth of Legal Services revenue. EBITDA margin rose to 42% of Revenue (FY 2013: 36%).

Quindell said it expects EBITDA margin to be between 40 percent and 45 percent, up from its previous range of 35% to 45% and that its adjusted operating cash flow was “significantly ahead of expectations and guidance” in the third quarter at £9.4 million compared to original guidance of break-even. But it said that full year revenue is likely to be between £750 million and £800 million. In July, it forecast the figure would be £800 million to £900 million.

The company also said that “The Board continues to consider and pursue, with advisors where relevant, all options available to it, including share buy backs, North American listing, disposal or demerger of assets or divisions and strategic and/or financial investments by third parties, in order to maximise shareholder value.”. It was the reference to disposals which have worried some investors, giving some credence that cash collection in the remainder of 2014 may be harder to come by than Chairman Rob Terry believes.

With the shares close to a 52 week low right now, the trading statement seems to have done little to repair the bruised share price. Gotham seems to believe that bankruptcy is on the cards and lets see how the company does on cash collection in Q4 2014 and Q1 2015. Quindell is still maintaining the guidance the company issued in July that cash inflows would be £30-£40 million for the 2014 financial year and would continue to grow to be up to £100 million in the first half of 2015 with the possibility of dividend payouts in 2015.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.