After a benign few months on the global stock markets, it has proved to be the calm before the storm as volatility returned with a vengeance last week and the outlook for the coming week doesn’t look any more settled.

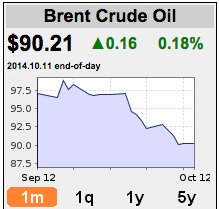

The FTSE All share and S&P 500 fell over 3% and the Nasdaq Composite dropped 4.5% with oil briefly dropping as low as $88 a barrel before bouncing back to close the week at $90, a four year low. The FTSE 100 hit a 52 week low of 6,339.

The swings in the US market have been incredible this week with the S&P 500 and Dow surging up and down as the Federal Reserve minutes briefly pushed markets up as they indicated that interest rates would be unlikely to rise any time soon in the United States but then worries came to the fore regarding global growth particularly with the eurozone struggling and likely to go back into recession and even Germany suffering from falling exports. With the fall in oil, energy stocks took a pounding and commodity focused companies fared little better.

After so many months of struggling to see a reason to buy into equities with the markets seemingly going up in a straight line and valuations stretched, the next couple of weeks should see many good buying opportunities being thrown up as the extreme volatility continues. Commentators are worrying about the impact of the strong dollar on the earnings of American companies and with so much money being pumped into large cap US companies in 2013 and 2014 it looks likely that the S&P 500 has further to fall after its 4-5% decline since the September highs. A fall in the US will of course drag down the other global bourses. Many energy stocks are looking good value with the likes of Shell now yielding over 5%. After sitting in mainly cash for quite a while, I have been starting to buy in and will continue to do so next week if the falls continue. Any hint of panic selling will offer up some juicy opportunities I am sure. Emerging markets and other riskier assets have not seen a dramatic sell off as yet but there’s still plenty of time in October for the bears to take control.

The latest US earnings season should give some clear insights as to the resilience of corporate earnings. With so little excitement in the stock market for so long, finally Mr Market seems to be offering up the chance to take advantage of investor fear which appears to be steadily mounting. Next week should be mighty interesting – hold onto your hats!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Bears take control of equity markets

Oct 12, 2014 at 10:12 am in Market Commentary by contrarianuk

After a benign few months on the global stock markets, it has proved to be the calm before the storm as volatility returned with a vengeance last week and the outlook for the coming week doesn’t look any more settled.

The FTSE All share and S&P 500 fell over 3% and the Nasdaq Composite dropped 4.5% with oil briefly dropping as low as $88 a barrel before bouncing back to close the week at $90, a four year low. The FTSE 100 hit a 52 week low of 6,339.

The swings in the US market have been incredible this week with the S&P 500 and Dow surging up and down as the Federal Reserve minutes briefly pushed markets up as they indicated that interest rates would be unlikely to rise any time soon in the United States but then worries came to the fore regarding global growth particularly with the eurozone struggling and likely to go back into recession and even Germany suffering from falling exports. With the fall in oil, energy stocks took a pounding and commodity focused companies fared little better.

After so many months of struggling to see a reason to buy into equities with the markets seemingly going up in a straight line and valuations stretched, the next couple of weeks should see many good buying opportunities being thrown up as the extreme volatility continues. Commentators are worrying about the impact of the strong dollar on the earnings of American companies and with so much money being pumped into large cap US companies in 2013 and 2014 it looks likely that the S&P 500 has further to fall after its 4-5% decline since the September highs. A fall in the US will of course drag down the other global bourses. Many energy stocks are looking good value with the likes of Shell now yielding over 5%. After sitting in mainly cash for quite a while, I have been starting to buy in and will continue to do so next week if the falls continue. Any hint of panic selling will offer up some juicy opportunities I am sure. Emerging markets and other riskier assets have not seen a dramatic sell off as yet but there’s still plenty of time in October for the bears to take control.

The latest US earnings season should give some clear insights as to the resilience of corporate earnings. With so little excitement in the stock market for so long, finally Mr Market seems to be offering up the chance to take advantage of investor fear which appears to be steadily mounting. Next week should be mighty interesting – hold onto your hats!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.