Brent Crude is currently down over a dollar a barrel to $83.5 a barrel with Nymex WTI Crude down to $78 a barrel as Saudi Arabia announced it was increasing the discount to USA refiners. This had led to worries that the Saudi’s may be about to enter a price war with domestic US producers in an attempt to disrupt the growing non-conventional oil sector which has seen dramatic growth in the last 2 years. The price of Saudi imports in the United States was set at a premium of $1.60 a barrel to the Argus Sour Crude Index for December, down 45 cents from November and it would sell its benchmark Arab light to customers in Asia at a discount of 10 cents a barrel to the Dubai/Oman contract in December, up from a discount of $1.05 in November. Oil has now dropped 25% since the high water mark in June of $115 a barrel due to slowing global demand and increasing production.

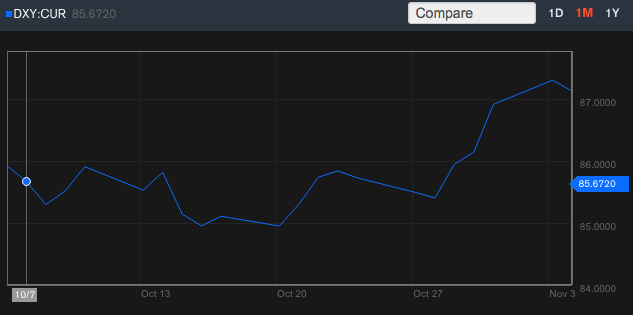

The news from Saudi Arabia wasn’t helped by further strength in the US dollar which has an inverse relationship with the oil price. The US dollar index which tracks a basket of currencies against the currency strengthened to 87, a 52 week high after a surge this week caused by the news from the Bank of Japan’s renewed reflationary programme which has hit the Yen badly but caused a surge in Japanese equities to levels last seen in 2007.

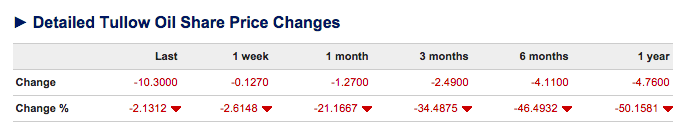

This has had the expected effect on UK listed oil shares this morning which had some respite in recent sessions as the oil price oscillated between $85 and $87. Previously the price had tumbled as Saudi Arabia announced big discounts on sales to Asia, but these price cuts were reversed in news yesterday for December deliveries. Shares like Tullow oil, Afren and Cairn Energy have tumbled to multi year lows, with both down around 50% in the last year.

Small cap oil shares have fared little better with bulletin board favourites like Xcite Energy and Rockhopper Exploration both feeling the heat of low oil prices for their projects on Bentley’s North Sea field and Sea Lion in the Falklands which are still in development and the appetite for companies operating at this stage of their evolution seemingly rock bottom right now.

Even M&A activity in the sector doesn’t seem to have helped, with Ophir Energy and Salamander Energy currently contemplating a merger, though in the case of the latter it has seen a 25% plus spike on the potential deal from pretty bombed out levels.

Amongst the carnage of the oil sector, those companies with hedged production and a profitable business at $75-80 a barrel are looking mighty interesting at these levels and for me Ithaca Energy and Faroe Petroleum stand out from the crowd with new production coming on stream from the Stella field in the case of the former in Q3 2015 (all being well) and a fully funded exploration programme in the North sea for 2015 and 2016 for the latter. It feels like trying to catch a falling knife right now but hopefully some stability should resume if OPEC behaves itself.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.

by contrarianuk

Oil crushed again as Saudi Arabia ups discount to USA

Nov 4, 2014 at 9:05 am in Market Commentary by contrarianuk

Brent Crude is currently down over a dollar a barrel to $83.5 a barrel with Nymex WTI Crude down to $78 a barrel as Saudi Arabia announced it was increasing the discount to USA refiners. This had led to worries that the Saudi’s may be about to enter a price war with domestic US producers in an attempt to disrupt the growing non-conventional oil sector which has seen dramatic growth in the last 2 years. The price of Saudi imports in the United States was set at a premium of $1.60 a barrel to the Argus Sour Crude Index for December, down 45 cents from November and it would sell its benchmark Arab light to customers in Asia at a discount of 10 cents a barrel to the Dubai/Oman contract in December, up from a discount of $1.05 in November. Oil has now dropped 25% since the high water mark in June of $115 a barrel due to slowing global demand and increasing production.

The news from Saudi Arabia wasn’t helped by further strength in the US dollar which has an inverse relationship with the oil price. The US dollar index which tracks a basket of currencies against the currency strengthened to 87, a 52 week high after a surge this week caused by the news from the Bank of Japan’s renewed reflationary programme which has hit the Yen badly but caused a surge in Japanese equities to levels last seen in 2007.

This has had the expected effect on UK listed oil shares this morning which had some respite in recent sessions as the oil price oscillated between $85 and $87. Previously the price had tumbled as Saudi Arabia announced big discounts on sales to Asia, but these price cuts were reversed in news yesterday for December deliveries. Shares like Tullow oil, Afren and Cairn Energy have tumbled to multi year lows, with both down around 50% in the last year.

Small cap oil shares have fared little better with bulletin board favourites like Xcite Energy and Rockhopper Exploration both feeling the heat of low oil prices for their projects on Bentley’s North Sea field and Sea Lion in the Falklands which are still in development and the appetite for companies operating at this stage of their evolution seemingly rock bottom right now.

Even M&A activity in the sector doesn’t seem to have helped, with Ophir Energy and Salamander Energy currently contemplating a merger, though in the case of the latter it has seen a 25% plus spike on the potential deal from pretty bombed out levels.

Amongst the carnage of the oil sector, those companies with hedged production and a profitable business at $75-80 a barrel are looking mighty interesting at these levels and for me Ithaca Energy and Faroe Petroleum stand out from the crowd with new production coming on stream from the Stella field in the case of the former in Q3 2015 (all being well) and a fully funded exploration programme in the North sea for 2015 and 2016 for the latter. It feels like trying to catch a falling knife right now but hopefully some stability should resume if OPEC behaves itself.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.