Financial Trading Patterns #4: STOP BUY

Nov 28, 2011 at 5:47 pm in Orders by

In this article I describe the STOP BUY trading pattern that utilises a stop order to buy, and in the next article I describe the more familiar (to most people) STOP SELL trading pattern that uses a stop order to sell.

NAME

STOP BUY

DEFINITIONS

A STOP BUY order is an order to BUY a security when the price rises to a specified level.

PARAMETERS

STOP BUY Trigger Price.

OBJECTIVE

The objective is to buy a rising stock or other financial instrument.

MOTIVATION

Momentum traders believe that a rising stock will continue to rise, and that it is even possible to ‘buy high, sell higher’. Alternatively, as expressed in the following scenario, the STOP BUY pattern allows you to ‘buy low’ as with LIMIT BUY, but without the potential loss.

SUCCESS SCENARIO(s)

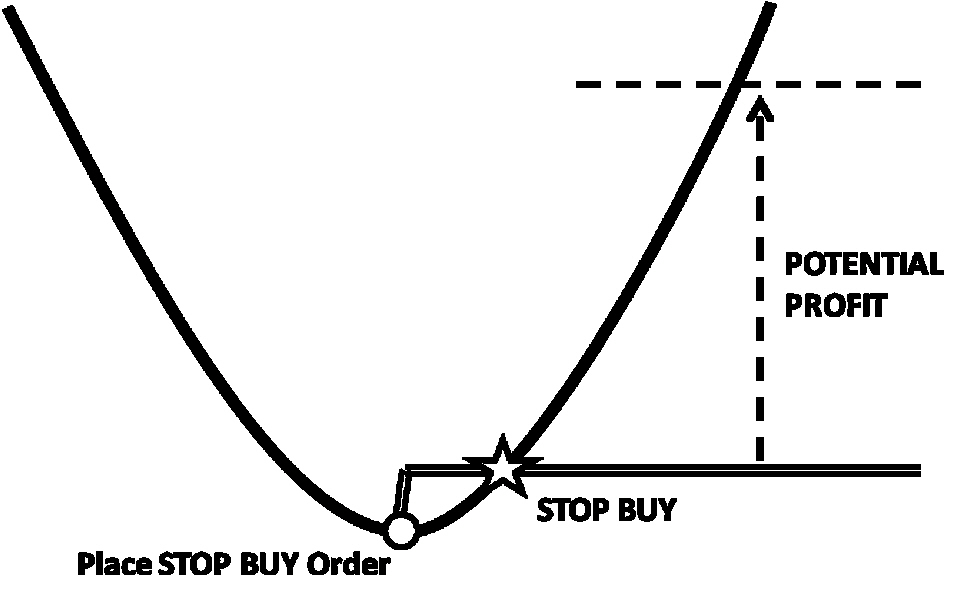

The following figure shows the STOP BUY success scenario. When we think the stock price has stopped falling, and is about to rise, we place a STOP BUY order to buy the stock if it rises to a specified level.

If the price continues to rise after the STOP BUY order has executed, we have a potential profit.

You will recognize this scenario as similar to the LIMIT BUY scenario, in the sense that we are looking to benefit ultimately from a price rise, but there’s an important difference. If the price falls immediately after we place the STOP BUY order, the order does not execute and we do not stand to make a loss.

FAILURE SCENARIO(s)

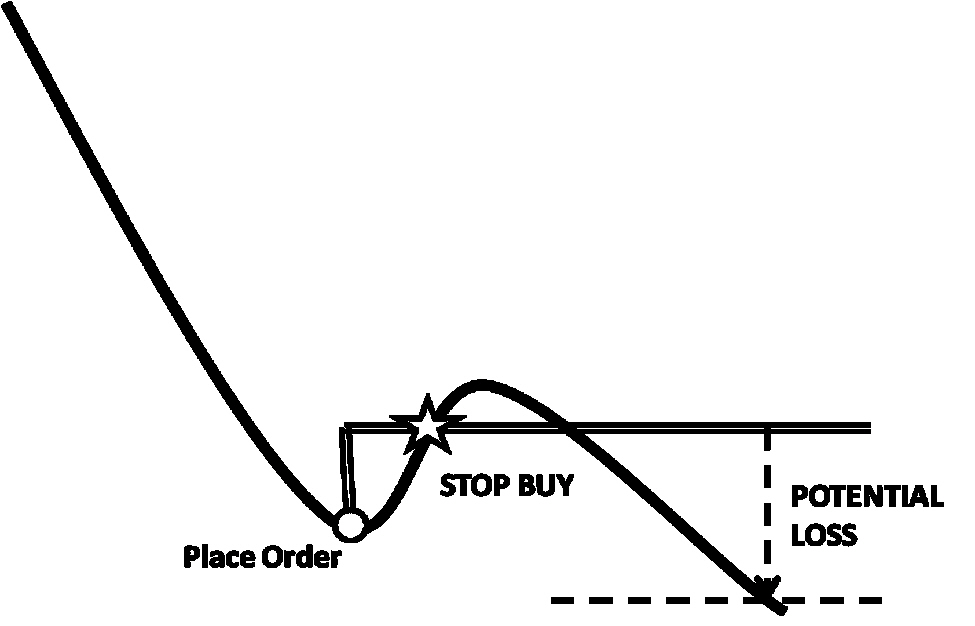

The following figure shows the most obvious failure scenario, in which the trend reverses and the price falls after the STOP BUY executes. This results in a potential loss.

This is not the only failure scenario. Another failure scenario is the one in which the price does not rise, but falls after we place the STOP BUY order. We do not make a loss, but we fail to realize additional profit if the price does eventually recover from a new low point up to our STOP BUY point.

APPLICATION

Your stockbroker should offer a STOP BUY order type, which executes when the price rises to a specified level, or will provide an order form via which you can specify the order type (as STOP) and the order direction (as BUY).

A spread betting order ticket may allow you to specify your order as a STOP order, or this may be inferred from the fact that an order to buy at a price above the current price must be a STOP BUY order.

In all cases you specify a target price at which you wish your chosen stock or other financial instrument to be bought long. Where the spread betting order ticket obliges you to specify this as a STOP order to BUY, you will likely encounter an error message if your target price is not above the current market price.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).