The Life of a Trade

Jan 31, 2012 at 12:41 pm in Tips and Strategies by

In a previous article titled Trade Exits: What’s Your Way Out? I suggested that many retail investors and spread bettors think only about their entries — i.e. which instruments to bet on, and when — and not their exits. The problem is actually wider than that, because many people also fail to think about what should happen in between the entry and exit; they fail to think about the life of a trade.

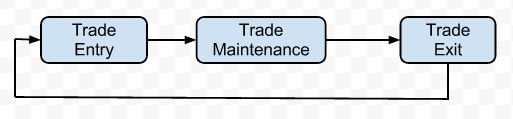

We can decompose the life of a trade into a lifecycle comprising Entry (what to buy and when), Maintenance (how to manage an open trade), and Exit (when and why to get out).

Let’s look at each of those stages in turn.

Trade Entry

Traders and investors enter into trades for different reasons. For day traders it will likely be purely for technical reasons, for investors it might be for fundamental reasons, and for position traders it might be a bit of both. The entry may take the form of a live trade at the current market price or it may take the form or an order to buy (or sell in the case of a short trade) when the price rises of falls to a particular level.

At the time of entry, the trader must decide on an initial position size and should already be planning his exit (discussed shortly).

Trade Maintenance

Except for very short term day trading, financial trading is not only about entries and exits. Longer-term trading styles like position trading and investment require us also to think about how to maintain our trade during the time between entry and exit.

The position size that you determined at entry need not be static. If the price of your chosen instrument falls so that your trade shows a paper loss, but not far enough to trigger your exit, should you add to the position by averaging down? If the price rises while you are holding a position, should you take the opportunity to pyramid some of your profit back into the same position? What do you mean, you never asked yourself those questions?

If you have a stop order in place on your position, should you trail it so as to “lock in” some of the accrued profit when the price rises? If so, at what distance?

I can’t provide you with perfect one-size-fits-all answers to those questions, but I can at least prompt you to ask those questions about trade maintenance.

Trade Exit

At some point during the life of your trade you need to think about when to exit, right? Wrong! As suggested in my article Trade Exits: What’s Your Way Out?, you should have though about your eventually exit when you entered the trade

In most cases you should have attached a stop order to your trade when you opened it, or prepared yourself for losing your entire stake by limiting that stake through prudent position sizing. With your stop order in place, or effectively at zero, your exit will be automatic and unemotional. There’s nothing to stop you making a discretionary exit or a partial exit any time you like, but you should at least have established what you default exit will be.

At the time you opened the trade, you may also have attached a profit-taking limit order to wholly or partially close the trade when it registers a certain amount of profit. Again, this exit will be automatic and unemotional.

When your trade does eventually exit, you have some cash with which to begin the lifecycle again.

The Life of a Trade and Different Trading Styles

For day traders it is probably all about the entries and the exists, with trade maintenance featuring very little if at all. In longer-term trading styles, maintaining a trade so as to stay in position while reaping more and more profit may be at least as important as — if not more so than — those entries and exits.

As a position trader, I know that my strategy is working when I spend more time maintaining my trades than I spend entering and exiting them.

Next time you trade…

Next time you rush into buying (or short selling) a hot stock, commodity, index or currency pair, you might stop for a moment to ask yourself two questions:

- When and how will I exit this position?

- What will I do (if anything) to maintain the trade before I exit.

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.