Is the Trend Your Friend?

Feb 1, 2012 at 12:56 pm in Swing Trading by

We’ve all heard the expression “The Trend Is Your Friend”, and in this article I examine whether the trend can be your friend.

What is Trend Following?

The “trend following” style of trading is a largely mechanical trading style predicated on the ideas that:

a) Every trader needs a favourable price trend, however short, in order to make money.

b) You can’t predict the onset of a trend, so it’s better to follow it once it’s started.

c) You can’t predict how long a trend will last, so you need to hold on for as long as possible… but no longer.

My own approach to trading has a significant trend following component consistent with points a) and c), but I am personally rather more skeptical of waiting until a trend has firmly established itself before deciding to “follow” it. Nonetheless, trend following purists argue that you don’t need to catch the exact turning points at all, providing you capture the major part of the price move.

Let’s look at a concrete example of how the trend might have been your friend.

The Trend Is Your Friend…

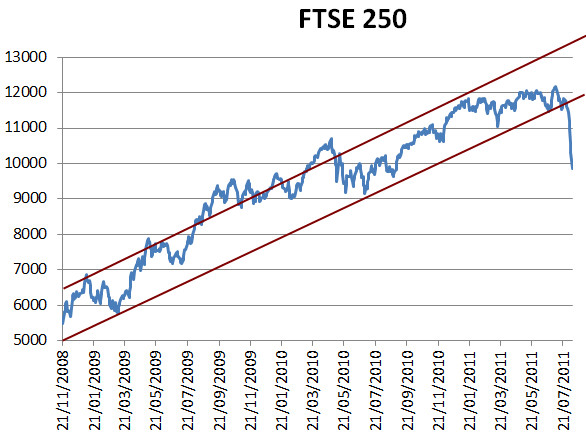

The following chart shows how you could have made an investment in the FTSE 250 in November 2008 and more than doubled your money by May 2011 simply by holding on for the bull ride. In spread betting terms, every £1-per-point that you bet could have made you about £6000 richer.

In this example you could have made even more money by pyramiding your investment (at least once, in July 2010) when the price met the lower trend line shown on the chart; although the complementary strategy of selling out or selling short whenever the price met the upper trend line could have left you out of position or adversely positioned for a significant amount of time in late 2009 / early 2010 — which goes to show the danger of “betting against the trend”.

My concrete example demonstrates how stock indices — and indeed commodities and individual equities — can be very trendy at times, and at those times it may be best simply to hold on. But be warned that the trend is only your friend…

..Until It Ends

At the very end of the chart you can see that the trend has come to an end, which is why it would have been so important to trail a stop order just below (but no closer than) the lower trend line. It would have gotten you out for a healthy profit before the profit slipped away… but not until the trend had run its course.

Easier Said Than Done

This is all very well in retrospect, isn’t it? From the chart you can see exactly when you should have made the initial investment or placed the initial spread bet. You can see exactly where you should have trailed your protective stop order, and when you should have let it do its job of closing you out without question. And in this particular example you can see the folly in trying to catch the tops of the counter-trend swings, although in some scenarios this additional strategy would have worked perfectly.

The major problem with trend following is that you only really know that you had a trend when it’s finished, or when it’s so well developed as to be almost finished. This leaves us with two options:

- Try to get on board just before the trend starts, and hold on for as long as you can once you’ve called it right, which is what I usually try to do.

- Try to jump on board at the earliest opportunity (but no earlier) once you see that a nice trend is developing, mindful of the fact that it could reverse — at least temporarily — as soon as you have jumped aboard.

Whichever way you do it, getting aboard the trend at the right time is not always easy and there might not be much that you can do about it apart from swallowing a few whipsaw losses while you get it right. But there’s one thing you can control, at least to some extent, and that is how long you hold with the trend. If you cash in your chips too soon, and the trend heads ever higher, you only have yourself to blame. Remember to hold on and run those profits, because…

The Trend is Your Friend!

(at least until it ends)

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.