Trading Trail #22: (Not) Following the FTSE

Dec 11, 2011 at 7:35 pm in Trading Diary by

Before I move on to the main feature of “Not Following the FTSE” I’ll update you on the progress of my Michael Page position that I told you about in my article TradingTrail #21: Not the Buying or the Selling, but the waiting. Having done everything right in catching the “fallen” knife, and having trailed my necessary guaranteed stop order up to almost break-even, I was disappointed to see this position stop out at the guaranteed price of 319.10p for a loss of £0.80 plus the £3.20 cost-of-guarantee.

Rather than getting hung up on “what might have been” on the upside, I console myself with “what might have been” on the downside. I could have applied a non-guaranteed stop order only to have seen the price gap-down again; or my guaranteed stop order could have triggered at the original lower level before I trailed it. Thinking about “what might yet be”, if the price falls again I might have another go.

Now for the main feature…

Not Following the FTSE

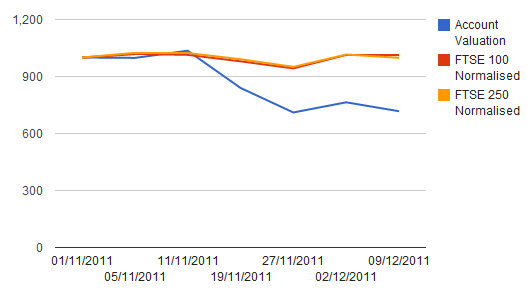

I thought it would be fun to start plotting the performance (or lack of it) of my Trading Trail portfolio against the FTSE, because I know some people like to see that kind of thing. So here is a chart constructed at 16:30 on Friday 9 December showing my portfolio value alongside normalised values of the FTSE 100 and FTSE 250 indices:

The passive index-tracking brigade will be pleased to see that I am currently under-performing the FTSE, but — to be honest — I couldn’t care less what the FTSE does as long as I make a lot of money in the end… and don’t lose a critical amount of it in the meantime. I’ve never seen much value in a professional fund manager who loses 20% (I can do that myself) but reports it as a “good performance” because the FTSE 100 lost 30%. Or one who makes a very modest 5% return at a time when there are multi-bagging profits on the table. I’m looking for an eventual absolute return by not following the FTSE up or down.

The passive index-tracking brigade will be pleased to see that I am currently under-performing the FTSE, but — to be honest — I couldn’t care less what the FTSE does as long as I make a lot of money in the end… and don’t lose a critical amount of it in the meantime. I’ve never seen much value in a professional fund manager who loses 20% (I can do that myself) but reports it as a “good performance” because the FTSE 100 lost 30%. Or one who makes a very modest 5% return at a time when there are multi-bagging profits on the table. I’m looking for an eventual absolute return by not following the FTSE up or down.

The pertinent word in the previous sentence is “eventual”, because currently my contrarian policy of “buying against the trend” with the hope of subsequently “holding with the trend” (when it reverses) has seen me in the short term being wrong-footed by the FTSE. But if you read “Appendix B – Performance Guide” in Michael Covel’s book “Trend Following: How Great Traders Make Millions in Up or Down Markets” you will see many examples of trend-following systems that have under-performed the wider markets in the short term only to completely trounce them in the long run. So that’s my plan!

Tony Loton is a private trader, and author of the book “Position Trading” (Second Edition) published by LOTONtech.