Trading Trail #13: Technically and Fundamentally I’m Bearish

Nov 15, 2011 at 11:58 am in Trading Diary by

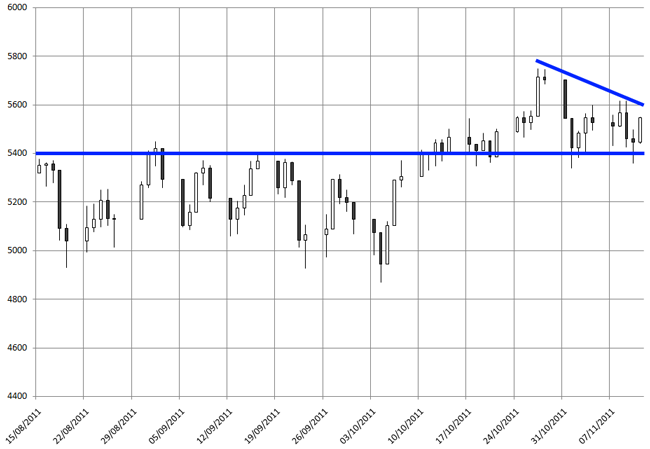

While I generally don’t go in for very much technical analysis “pattern spotting” (except my prognosis here) I have noticed that over the past couple of weeks the FTSE 100 has been tracing what appears to be a bearish descending triangle characterised by a series of equal lows (at a support level corresponding with prior resistance) and lower highs as you can see at the end of the chart here:

Coupled with the fundamental fact that European governments are in disarray over how to tackle the Euro crisis, and with Angela Merkel calling this “The worst hour since World War Two”, things are not looking too good. Especially not for my predominantly-long position trading strategy that aims to benefit (eventually) from rising prices.

Coupled with the fundamental fact that European governments are in disarray over how to tackle the Euro crisis, and with Angela Merkel calling this “The worst hour since World War Two”, things are not looking too good. Especially not for my predominantly-long position trading strategy that aims to benefit (eventually) from rising prices.

On the other hand, falling prices might present buying opportunities — be greedy when others are fearful, and all that — for those who have funds to spare. Which is why I need to be careful now not to blow the remaining £176 trading budget on anything too rash! And which is why I’m now inclined to trail the stops on my profitable positions a little more aggressively than ideally I would like.

Yesterday the portfolio value reached the dizzying height of £1075 (a 7.5% profit within a couple of weeks) before falling back to £1017 by close-of-play. The account not in loss, but it could soon be, and we’ll see.

I should also point out that while a rising tide lifts all boats, and the opposite is true for a falling tide, my diverse portfolio should (for good or for ill) not follow the fortunes of the FTSE exactly. There’s a chance, only a slim one, that when the FTSE falls my portfolio will rise… but I wouldn’t bet on it. Or maybe I am betting on it?

Technically and fundamentally, I’m bearish, and I should therefore be selling short everything in sight. But it wouldn’t fit my philosophy, and I have a sneaky feeling that the markets might do exactly the opposite of what I expect them to do.

While we can be bullish or bearish in our predictions, all we can really say about the markets is that “they will fluctuate”. And you can’t prove me wrong on that one!

Tony Loton is a private trader, and author of the book “Stop Orders” published by Harriman House.