After profits warning, Vodafone shares with over 5% yield look interesting

May 21, 2014 at 8:45 am in General Trading by contrarianuk

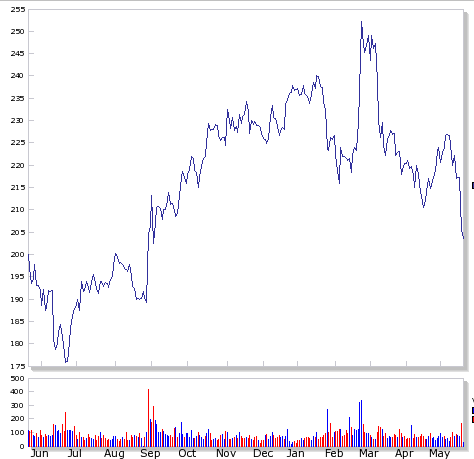

Vodafone shares dropped 5.5% yesterday and a further 2% today to hit 202p, after delivering a profits warning for 2015 with their results for the year ending March 2014.

But for income hunters, the mighty fine yield of over 5% and progressive dividend policy makes the company worth a look despite the problems the company is having in Europe. They declared a final dividend per share of 7.47 pence, giving total dividends per share of 11.0 pence, up 8%. Vodafone is committed to annual growth in dividends even if they will be uncovered for the next two years by operating cash flows.

Group revenue was down 1.9% to £43.6 billion and EBITDA was down 7.4% at £12.8 billion with margins down 1.3%. Adjusted operating profit was £7.9 billion, including £3.2 billion for Verizon Wireless to 2 September 2013. Vodafone pre-tax profit was £44.5 billion because of the sale of the 45% stake in Verizon Wireless for $85 billion. Without this disposal, it made a pre-tax loss on continuing operations of £5.3 billion.

Vodafone warned that 2015 earnings would be hit by a huge £7 billion investment in high speed 4G services and also it announced a further write down in its European operations of £6.6 billion as price competition intensifies (Germany, Spain, Portugal, Czech Republic and Romania) making the total impairment charge around £20 billion since 2011. Vodafone said the write-off was driven by reduced cash flows as a result of the “tougher macroeconomic environment and heavy price competition”.

Italy and Germany were particular black spots. European organic service revenues which take into account foreign exchange changes and acquisitions, dropping 9% and total performance round the world down 4.3% despite a 6.1% growth in emerging markets with India’s growth of 17% being the stand out perfomer.

Vittorio Colao

Vittorio Colao, the chief executive, is betting that organic investments of around £19 billion over the next two years, including “Project Spring” will deliver further organic growth down the road and hoping that growth in emerging markets is sustained. The “Project Spring” programme of investment will enable it, by 2016, to offer 4G services to more than nine in 10 people across Europe, while more emerging market customers will have access to 3G mobile internet.

Vodafone’s shares have also been hit by the $50 billion acquisition of DirecTV by AT&T in the United States which makes a bid for Vodafone by AT&T very unlikely.

The company is guiding for earnings of £11.4-11.9 billion for the 2014/15 financial year excluding one off’s, with around £1.1 billion accounted for by foreign exchange changes compared with £12.8 billion in 2013/14. Though there’s plenty of pressure on the company and Project Spring’s investment in 3G and 4G services needs to pay off, the management seem keen to prioritise dividend payments. With a yield of 5.2% there’s not many companies out there with a similar risk profile offering this kind of return. There are risks of course – Espirito Santo analyst Robert Grindle warned that “visibility of success is low and competitive forces remain substantial”. But i’ve put a few in my SIPP and lets see if Colao can deliver with the dividend cushion giving reassurance that you are being paid to wait.

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.