More bad news for accident prone Cairn Energy

Mar 17, 2014 at 10:23 am in General Trading by contrarianuk

Cairn Energy isn’t having much luck these days after the glory days of 1999-2004 in India’s Rajasthan area. It found large amounts of oil in the Guda field (1999), followed by Saraswati (2001), Mangala (2003) and Mangala fields (2004). Cairn sold 58.5% of Cairn India for $8.67 billion in August 2010 to Vedanta Resources, with the company selling $5.5 billion of shares.

The three major fields in Rajasthan have produced $18bn (£10.7bn) in revenue since they came on stream with the $3.5 billion pay out out the high point for shareholders in 2012. But the positivity was soured by an announcement on 24th January 2014 that Cairn has been contacted by the Income Tax Department of India to discuss income tax assessments for the year ending 31 March 2007 with the authorities instructing Cairn Energy PLC to hold its shares in Cairn India until the investigation was complete. The news wasn’t well received by the markets given the protracted period of time many of these tax investigations take to get concluded including the possibility of lengthy and expensive court action.

Following the windfall from the sale of the Cairn India stake, the company which was founded in 1981 by Sir Bill Gammell, the former international Rugby player, went on a high risk and controversial exploration programme in Greenland which ultimately failed to find commercial hydrocarbons. Cairn spent $1.2 billion drilling eight wells in 2010 and 2011 without striking oil. In early 2012, the company farmed out some of its Greenland licences to Statoil of Norway. Cairn is proposing to drill the Pitu prospect, which is covered by 3D seismic in the second half of 2014. A joint venture (Cairn (56.825%), Nunaoil (12.5%), Statoil ASA (30.625%)) drilling decision will be taken on the proposed well the coming months after expectations of a decision last year. Clearly Cairn and its partners are treading carefully given the high risk, high reward nature of the offshore drilling with the additional expense of two drilling rigs being needed in case of well problems to minimise the potential of environmental damage.

After buying Nautical Petroleum for $680 million and Agora Oil and Gas for $453 million in 2012 , Cairn seemed to have learnt that their success in India wild cat drilling was far from guaranteed in other parts of the world. In Greeneland the chances of success (COS) was no more than 1 in 10 for each well.

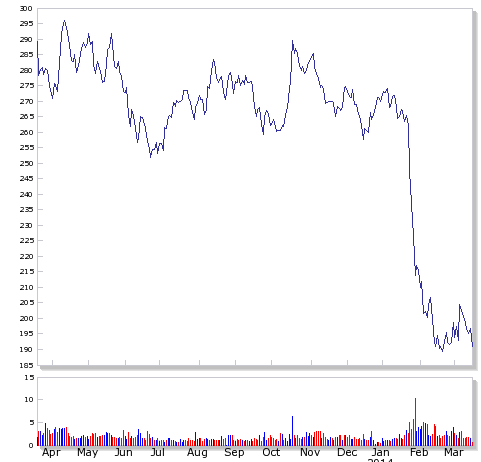

With a plummeting share price it was no surprise that when it was announced earlier this month that Bill Gammell was leaving the company in May 2014.

Today the company’s run of bad luck with the drill bit seems to be continuing. The JM-1 well offshore Morocco (Cairn Working Interest (WI) 37.5% and Operator) drilled to evaluate Upper Jurassic and Middle Jurassic objectives reached a total depth of 3,711m TVDSS and has been plugged and abandoned without testing.

The shares dropped a further 5p on the news to 191p, close to their 52 week low and far from their 52 week high of 296p. The market cap is now £1.1 billion, which seems pessimistically low given the $1 billion of cash left on its balance sheet and remaining 10% holding in Cairn India.

The shares dropped a further 5p on the news to 191p, close to their 52 week low and far from their 52 week high of 296p. The market cap is now £1.1 billion, which seems pessimistically low given the $1 billion of cash left on its balance sheet and remaining 10% holding in Cairn India.

Cairn said its next well in the nine part exploration programme is FAN-1, in the Sangomar, Sangomar Deep and Rufisque blocks offshore Senegal. I’m sure the head of exploration is hoping for better luck this time and the failure in Morocco may make the company even more reluctant to commit even more money to the Greenland adventure.

The company looks an interesting prospect if Cairn India’s tax issues can be resolved sooner rather than later given their quality assets in the North Sea acquired with the Nautical and Agora acquisitions. Given the low price of small cap oil companies right now, it would seem to be in the shareholders interest to abandon Greenland and continue acquiring at these bombed out valuations. Why spend another $500 million on wild cats when a $1-2 billion would buy plenty of companies in safer waters like the North Sea.

FOLLOW UP FOLLOWING RESULTS MARCH 18th

Cairn shares are down a further 8% to 180p after it said it would halt a $300 million share buy-back programme while Indian tax authorities assess income taxes dating back seven years, with around $100 million already complete. The company reported a 2013 loss of $556 million after costs for unsuccessful exploration in Morocco and the North Sea. Exploration costs rose 34% year on year to $213 million, which included $107 million spent on drilling offshore Morocco and $81 million in the Norwegian and UK parts of the North Sea.

180p….wow!

Contrarian Investor UK

IMPORTANT: The posts I make are in no way meant as investment suggestions or recommendations to any visitors to the site. They are simply my views, personal reflections and analysis on the markets. Anyone who wishes to spread bet or buy stocks should rely on their own due diligence and common sense before placing any spread trade.