Financial Trading Patterns #3: LIMIT BUY, LIMIT SELL

Nov 25, 2011 at 5:21 pm in Orders by

This is the first article in which I will combine two of the previously-defined financial trading patterns — LIMIT BUY and LIMIT SELL — so as to create a composite pattern called LIMIT BUY, LIMIT SELL.

NAME

LIMIT BUY, LIMIT SELL

DEFINITIONS

A LIMIT BUY order is an order to BUY a security when the price falls to a specified level.

A LIMIT SELL order is an order to SELL a security when the price rises to a specified level.

PARAMETERS

LIMIT BUY Trigger Price.

LIMIT SELL Trigger Price.

OBJECTIVE

The objective is to buy low, sell high.

MOTIVATION

Swing traders in particular want to “buy low” at the bottom of a trading range and “sell high” at the top of a trading range, possibly repeatedly.

SUCCESS SCENARIO(s)

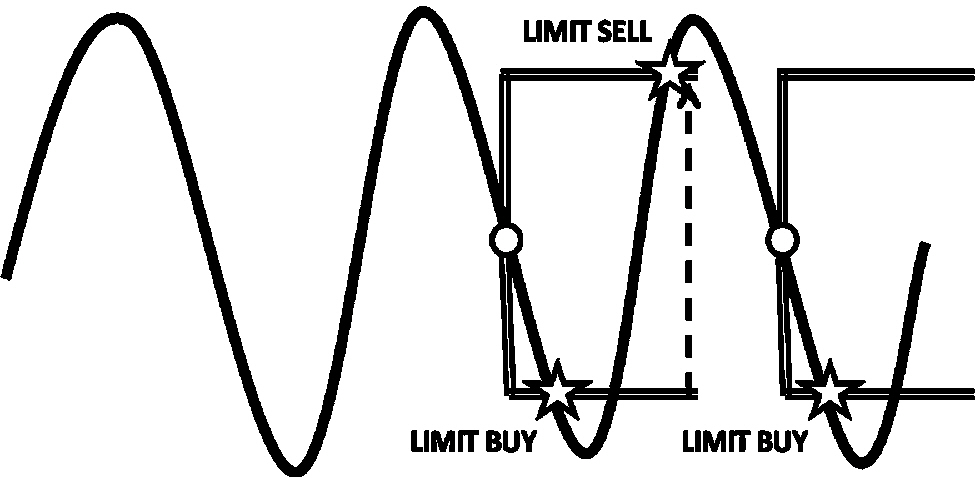

The following figure shows a stylistic representation of the LIMIT BUY, LIMIT SELL swing trading success scenario.

After witnessing a few regular peaks and troughs, we identify what we consider to be a financial instrument’s trading range. We place a LIMIT BUY order to buy-in near the bottom of the trading range, and a LIMIT SELL order to sell-out near the top of the trading range.

If all goes according to plan, our profit is the difference between the LIMIT BUY and LIMIT SELL prices. We can repeat the pattern as long as the price continues to oscillate within the trading range.

FAILURE SCENARIO(s)

There are several possible failure scenarios for this pattern as follows:

• The trading range breaks down and the price continues to fall after the LIMIT BUY executes, resulting in increasing loss.

• The trading range breaks down and the price continues to rise after the LIMIT SELL executes, resulting in unrealized profits (or increasing loss if net short).

• The trading range narrows, so the orders do not execute.

The first two failure scenarios can be mitigated by placing protective stop orders above and below the trading range.

APPLICATION

You implement this pattern using your stockbroker’s LIMIT BUY and LIMIT SELL order types, and for each order, you specify a price at which you wish the order to execute.

In a spread betting account you may be able to place both orders simultaneously, whereas in a regular stockbroker account you will likely only be able to place a LIMIT SELL order on a stock that you actually hold – i.e. after the LIMIT BUY order has executed.

The spread bettor’s use of this pattern might include going “net short” at the top of the cycles, by placing a LIMIT BUY order at £1-per-point and an opposing LIMIT SELL order at £2-per-point as I described here.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).