The trading platform is slick, quick easy to navigate and laid out well. Most functionality (i.e. setting up orders) can be accessed within 3 clicks. I like the IT Charts and how you can get them to display seconds and minutes breakdown. Tight, fixed spreads which is quite good when I'm utilizing my short term trading style. InterTrader also offer a free complimentary demo account to try the platform risk-free before investing any money into an account. Get your demo account here.

InterTrader also offer complimentary free access to a live squawk feed, which is a brilliant. Plenty of free educational material and live webinars...etc.

But my primary reason for using InterTrader is that there is no slippage on market execution trades; deals are either filled or killed. As opposed to fulfilling your deal at the next available price, InterTrader will return an execution error but if you press the trade button again the system will execute your deal at the price displayed on-screen. Some traders might like this, others might not but I think this is fairer than having trades executed at inferior prices. Note that executions errors are only encountered during period of very high volatility.

'Shai Heffetz, Managing Director of InterTrader said: We're convinced that clients will appreciate our exceptional liquidity. We offer a low-latency trading environment combined with multiple execution venues to provide best execution prices. Our service has attracted many partners to date including FCA-regulated asset managers and investment funds.

Many spread betting firms focus their efforts louring traders to use their services with exceptional bonuses and safety nets, this is nice and beneficial for all sides involved but, what about keeping the loyal customer happy, does your spread betting broker reward you for trading with him overtime?

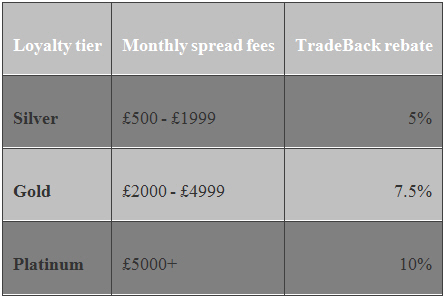

InterTrader decided to take a stand and reward loyal traders in the best way possible cash. InterTrader's loyalty programme called TradeBack™ rebates traders every month for a fraction of the total spread fees paid over a month regardless of P&L the more you trade the higher the rebate rate and the overall rebate will be. InterTrader.com use the following table when calculating rebates.

|

Let's use an example to better illustrate how it works -:

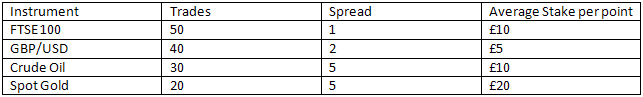

Monthly trading log Mr Trader

|

The calculation will be the following -:

(50X1X10)+ (40X2X5)+ (30X5X10)+ (50X5X20) =7,400 X 10% = £740 rebate.

On the first week of the following month Mr Trader will receive £740 directly to his trading account no strings attached.

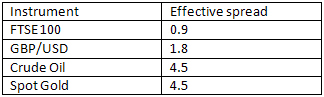

Traders are always looking for the tightest spreads around, if Mr Trader will calculate what was the effective spread on his trade he will find out that it was -:

|

With the 'Tradeback' rebate programme you can get back part of the spread commission. For instance if you execute 200 trades on the FTSE 100 where the spread is 1 points staking an average of £10 per point, the rebate would amount to £300 regardless of the P&L for the trades. [200 (trades) x 1 (spread) x £10(stake) x 10% (Tradeback)= £200].

The InterTrader loyalty programme is available to all traders who sign up from FSB, once an account is live it is automatically entitled to enjoy TradeBack rebates. Note also that the Gold bid-offer spread is now 4 points.

You can rest assured that your funds are safe with InterTrader. InterTrader benefits from a parental guarantee from its mother company: GVC Holdings PLC; a multi-national trading company quoted on the LSE with a market capitalization of 2 Billion. All client funds at InterTrader are underwritten and guaranteed by GVC Holdings PLCG irrespective of the amount. This goes well beyond the GICS mandate to protect clients' funds.

Verdict: InterTrader gets a thumbs up from us even if I have reservations on their interbank prices. I don't believe a trading company would give you the same spreads they get and only charge volume commission as their sole source of revenue. In fact, InterTrader do say that they'll give you interbank spreads but then state that they'll incorporate a dealing charge in the spread... But at the end of the day I take the view that the spread is what it is: either one can work with it or one can't. If we can find a provider that gives us fair pricing, fast execution and doesn't interfere and lets us get on with it then we're on to a winner. You don't really need anything else, the rest is all bells and whistles.

Note: Spread betting and CFD trading carry a high level of risk to your capital and can result in losses that exceed your initial deposit. They may not be suitable for everyone, so please ensure that you fully understand the risks involved.

The content of this site is copyright 2016 Financial Spread Betting Ltd. Please contact us if you wish to reproduce any of it.