Financial Trading Patterns #6: STOP BUY, STOP SELL

Nov 29, 2011 at 7:26 pm in Orders by

This is the second article in which I combine two previously-defined trading patterns in order to create a more complex composite trading pattern.

NAME

STOP BUY, STOP SELL

DEFINITIONS

A STOP BUY order is an order to BUY a security when the price rises to a specified level.

A STOP SELL order is an order to SELL a security when the price falls to a specified level.

PARAMETERS

STOP BUY Trigger Price.

STOP SELL Trigger Price.

OBJECTIVE

The objective is to buy at the onset of an uptrend, sell at the onset of a downtrend.

MOTIVATION

This pattern could be used for the same purpose as the LIMIT BUY, LIMIT SELL pattern; i.e. to buy low and sell high. By using STOP orders rather than LIMIT orders we benefit because:

- We buy when the price is rising and is therefore (we assume) more likely to continue rising.

- We only sell when the price starts to fall, not when it reaches an arbitrary level below the true profit potential.

This pattern might also be used for momentum trading. That is: buy a rising stock high, sell it even higher.

SUCCESS SCENARIO(s)

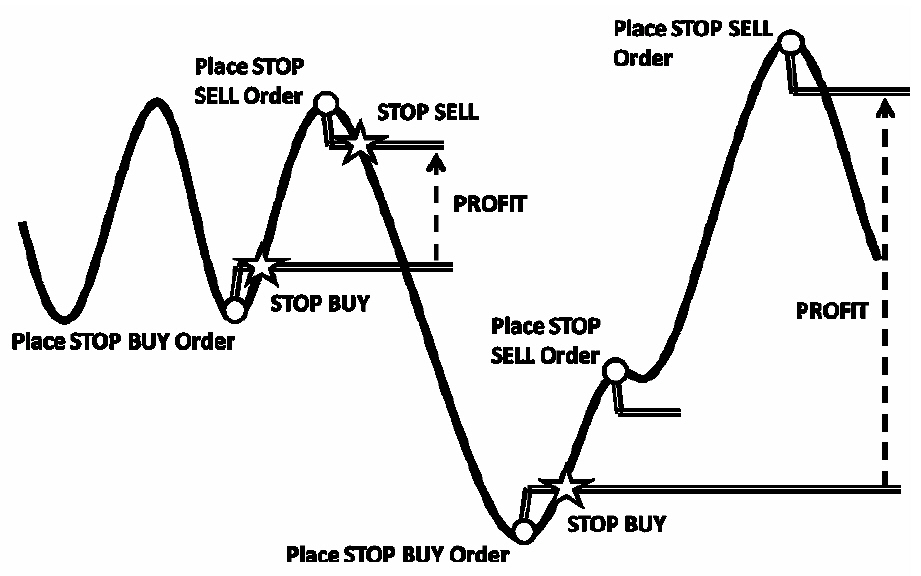

The following figure shows two success scenarios in one:

- In the first scenario we observe a trading range. At the bottom of the range we Place a STOP BUY order, which is executed on the upturn. At the top of the range we Place a STOP SELL order, which is executed on the downturn; thus securing a profit. Compare this scenario with the LIMIT BUY, LIMIT SELL scenario for swing trading.

- In the second scenario, we observe that the price is at a low point. We Place a STOP BUY order, which is executed on the upturn. When we think the trend is reversing we Place a STOP SELL order, which is not executed because the uptrend re-establishes. The price rises considerably and at the next anticipated trend reversal we Place a STOP SELL Order; which is executed, thus securing a profit.

In the second success scenario you will have noticed that we placed two STOP SELL orders in succession, the second one at a higher level. In effect we’ve used a TRAILING STOP, which is the next pattern that we’ll consider.

FAILURE SCENARIO(s)

There are several possible failure scenarios, combining the failure scenarios for the separate STOP BUY and STOP SELL patterns presented earlier. A selection of the failure scenarios are as follows:

- The trend might reverse immediately after our STOP BUY triggers, taking us into loss.

- The trend might reverse after triggering our STOP SELL, so that that we miss out on further profit potential.

- When we place the STOP BUY order, the price might fall significantly, rather than rising and triggering our order. If the price subsequently rises all the way back up to our STOP BUY level, we buy-in having missed the additional profit potential of the fall-and-rise.

- When we place the STOP SELL order, the price might rise significantly, rather than falling and triggering our order. If the price subsequently falls all the way back down to our STOP SELL level, we sell-out having missed the additional profit potential of the rise-and-fall.

The first two failure scenarios result in whipsaw losses, which can be minimized by placing additional (contingent) protective stop orders. The second two failure scenarios can be mitigated through the use of TRAILING STOP orders, discussed next.

APPLICATION

This pattern is implemented by combining the STOP BUY and STOP SELL financial trading patterns.

As described here, this trading pattern implies a “long” strategy of using a STOP BUY order to enter a position and a corresponding STOP SELL order to exit the position. A spread bettor — but not a regular retail stock holder — could turn this trading pattern entirely on its head by using a STOP SELL order to enter a short position and a corresponding STOP BUY order to exit the short position.

This article has been devised and adapted from original text and pictures included in the book “Financial Trading Patterns” by Tony Loton (with permission).